Ever wonder what’s the secret behind a successful business? Efficient bookkeeping. Yeah, that’s right! The backbone of any thriving business is strategic financial management which can’t be possible without assistance from free bookkeeping software.

In this digital age, swapping manual entries for automated systems has become an inevitable practice to keep up with the demanding pace of entrepreneurship.

Isn’t it relieving to know that in a world full of expensive things, you can use powerful tools without breaking the bank?

Yes, there exist free bookkeeping software services that ease your financial tracking without adding extra cost! In 2025, even more refined options are available to elevate your accounting skills: ZipBooks, GnuCash, Wave Accounting, and many more!

14 Best Free Bookkeeping Software in 2025

Navigating the world of finance can be tricky, but by choosing the right free bookkeeping software, I’ve found it’s possible to simplify this process.

In 2025, there are several outstanding platforms available that will not only make tracking income and expenses easier but will help businesses grow and prosper. Let’s discuss some of them.

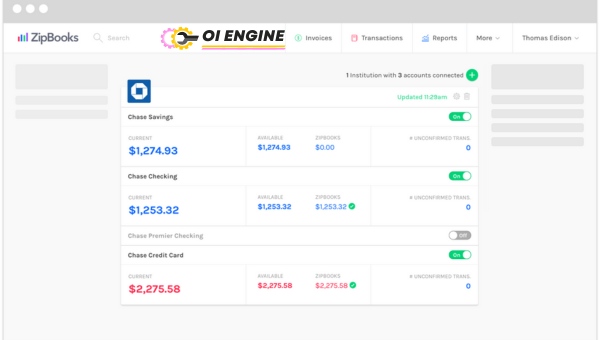

1. ZipBooks

The first standout on the list is ZipBooks. This free bookkeeping software has a plethora of features perfect for small businesses, freelancers, or even large corporations.

Among its key features are automated invoicing, expense tracking, and easy receipt capturing via its mobile app.

Important features include:

- Tracking and organizing costs as well as employing insightful reports to facilitate smarter decisions

- Tools for sending professional invoices swiftly

- An efficient tracking system for time and projects helps maintain accuracy

- The bank synchronization feature avails real-time updates on transactions

- Functionality enabling effective collaboration with team members

Pros:

- It’s user-friendly with intuitive navigation.

- Provides real-time insights which means active management is easier.

- Offers long-term financial planning tools that aid growth.

- The platform provides excellent customer support.

- Automated reminders ensure all bills get paid on time.

Cons:

- There might be limitations when dealing with multiple currencies.

- Its mobile app lacks some of the desktop version functionalities.

- Some users have reported data synchronization issues between platforms.

- Advanced reporting options come at an additional cost.

- Certain users may find the lack of integration with third-party apps frustrating.

Also Read: GPS For Truckers: Unveil Top Navigation Picks!

2. GnuCash

GnuCash – is designed for both personal and small business finances. It excels in facilitating comprehensive tracking of bank accounts, stocks, income, and expenses for multiple currencies.

- Double Entry: Every transaction must debit one account and credit others by an equal amount which ensures the equation is always in balance.

- Scheduled Transactions: Reminders of upcoming transactions are part of this feature, ensuring you never miss a payment.

- Reports and Graphs: Analyze your finances in detailed reports and visual graphs.

- Financial Calculations: Quick math done right in the register for calculating compound interest.

- Small Business Accounting Features: Keep track of customers, vendors & jobs with this feature built for small businesses.

Pros:

- GnuCash supports complex accounting tasks while being accessible to beginners too.

- It offers detailed reports and graphs for in-depth analysis.

- With its double-entry feature ensuring balanced books always, it’s a stable platform you can rely on.

- The ability to import data from other software certainly adds flexibility.

- The fact it operates over multiple platforms ensures easy access at all times

Cons:

- Some users might take time to adjust to its interface.

- Potentially, a steep learning curve for those who aren’t familiar with accounting concepts.

- One of the primary drawbacks is occasional software crashes.

- A lack of customer support can be challenging when problems arise.

- It doesn’t offer an application for smartphone users.

3. Wave Accounting

Wave Accounting software streamlines invoicing and receipt scanning without any hidden fees. Its cloud-based system is perfect for independent contractors and small businesses managing their finances.

- Unlimited Bank & Credit Card Connections: This feature provides an infinite number of links between the software and banks or credit cards making transactions smoother than ever before.

- Unlimited Income & Expense Tracking: There are no restrictions when it comes to keeping track of income or expenditure which makes for better financial clarity.

- Customizable Invoicing: This enables the creation of professional personalized invoices representing your brand’s identity.

- Contacts Management: Keeping a record of contacts was never this easy – just a click away!

- Synchronizable Features: Synchronizes transactions to balance books automatically making processes hassle-free.

Pros:

- Seamless integrations with PayPal, Stripe, and other payment platforms make transactions easier.

- The automatic syncing between all devices ensures up-to-date bookkeeping.

- The ability to generate various financial reports offers valuable insights into your business’s performance.

- Most impressive might be that Wave Accounting not only tracks your expenses but also categorizes them automatically.

- Customized invoices provide a professional look that impresses clients.

Cons:

- Payroll services are restricted to certain countries which may limit some users.

- Lack of inventory tracking could create inconvenience for certain types of businesses.

- Some customers have reported slow load times on the application which could affect productivity levels.

- The absence of a multi-user feature means it needs access per individual machine all at once (no simultaneous log-in).

- Finally, at times, incomplete integration with some banks can cause you minor frustrations.

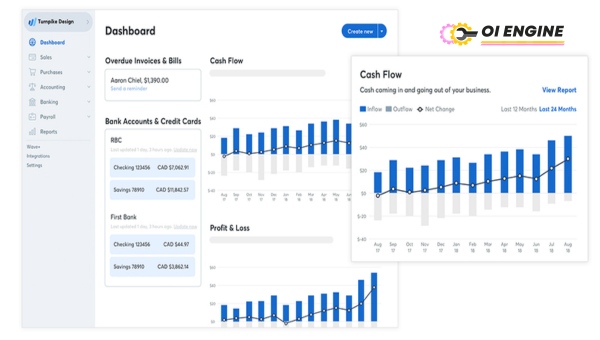

4. Zoho Books

Zoho Books is a cloud-based accounting software that assists small to medium-sized businesses with their financial needs. Its features include automated banking, inventory tracking, and online collaboration with customers.

- Client Portal: Shared space with clients so both parties can discuss and settle invoices seamlessly.

- Timesheets: Log hours of work to facilitate easy billing and payroll computations.

- Recurring Transactions: Automate repeating invoices, bills, and expenses to save time on data entry.

- Inventory Management: Monitor inventory levels for timely replenishment.

- Mobile Access: Stay connected even on the fly from your smartphones.

Pros:

- Zoho Books offers a user-friendly interface. This makes navigation quick and efficient.

- It has extensive invoicing options, enabling businesses to create professional and custom invoices.

- The inventory management system in Zoho Books is comprehensive, allowing the tracking of products very effectively.

- It provides 24-hour customer support, which can be extremely helpful when dealing with financial matters.

- Notably, it offers the ability to connect to your bank account for real-time updates on income and expenditure.

Cons:

- A limited number of users can access the program. This could be problematic in larger businesses where several people need to have access.

- The customization options are somewhat reserved compared to other software.

- Integrations with certain other applications like PayPal do not operate as smoothly as they should ideally do.

- Data security could be improved for users to feel entirely secure while using the program.

- Although cloud-based software is handy, there are times when server issues may stop you from accessing it.

Also Read: 10-Best-Trucking-Bookkeeping-Software

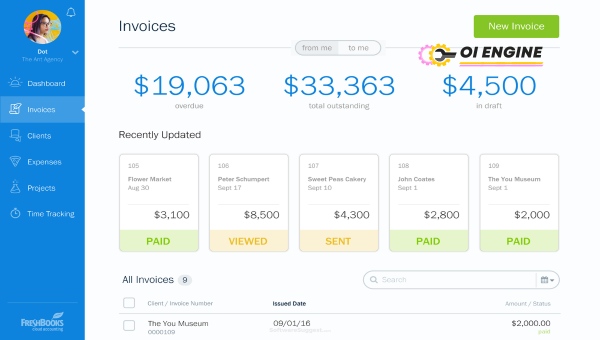

5. FreshBooks

As versatile free bookkeeping software, FreshBooks caters mostly to freelancers but can accommodate small businesses as well. Its features include invoicing, expense tracking, time-tracking capability, and more.

Time-tracking tool: Time as money is measured accurately using this tool.

- Expense Tracker: Keeps your expense records in check and helps you analyze where to cut down.

- Project Management Tools: Assign and manage tasks efficiently with these integrated tools.

- Cloud-based Software: Access your FreshBooks account anytime, anywhere.

- Invoicing Features: Easy-to-use templates that let you send professional invoices quickly.

Pros:

- FreshBooks shines through with its sleek user interface that’s both intuitive and pleasurable for daily use.

- The platform’s top-rated feature might just be its time-tracking capability which allows firms or contractors who bill hourly to easily log their work hours right from inside the system itself.

- FreshBook’s superb reporting feature also makes it a big standout among its competitors. Businesses will find concise reports on profit & loss statements – all readily available at their fingertips.

- Customers can pay directly via invoices and businesses can offer discounts or late fees as required.

- FreshBooks comes with a substantial suite of integrations that helps it mesh well with an existing software ecosystem.

Cons:

- Freshbooks does not provide payment processing thus users will have to sync a third-party payment processor for this feature which can seem daunting.

- Its inventory tracking system is relatively basic compared to other bookkeeping software.

- Creating custom reports may not be its strongest point. There are limitations in terms of the type of reports one can create.

- Unlike competitors, there’s no built-in payroll system provided by FreshBooks itself; this means users will need to rely on integrations for such services.

-An important drawback is it only allows access for one user per business; additional users come at an extra cost.

6. NCH

NCH Express Accounts is a free bookkeeping software best suited for smaller businesses and delivers comprehensive recording and reporting functionalities.

- Accounts Payable Management: No more overdue payments with this amazing feature.

- Tax Management: Keeps track of your tax information to avoid any year-end rush.

- Invoice Management: Create professional invoices with just a few clicks.

- Inventory Management: Be aware of low stocks before they run out.

- Data Import/Exports: Effortless data transfer can make life pretty straightforward.

Pros:

- The NCH system provides comprehensive capabilities to track sales and accounts receivable accurately, eliminating any undue financial errors in this regard.

- The system supports various forms of taxation rules making a business compliant with different regions’ tax laws instantly.

- NCH’s detailed financial analysis and reporting allow effective planning for future investments.

- Never lose time again – the automatic backup feature ensures that all company data is consistently secured without requiring active management from the user side.

- Businesses utilizing NCH’s multiple warehouse tracking will find managing stock between locations quite easy.

Cons:

- The complexity of the user interface could be overwhelming at first glance as much information is displayed simultaneously confusing new users.

- Possibly due to their focus on small business needs, there are caps on certain functionalities that could limit growth or expansion into larger markets.

- Due to its lack of cloud storage facilities, data accessibility might be restricted based on your local storage.

- Another disadvantage is that the service lacks a payroll system, which means an additional application is necessary to manage employee payments.

- The integration options are somewhat limited in comparison with competitors. This might smooth operation difficult if one wishes to incorporate additional functionalities.

7. Odoo

Odoo is an all-in-one business software that offers a variety of services including CRM, website/e-commerce, billing, accounting, manufacturing, warehouse – and project management, and inventory.

When it comes to bookkeeping, the comprehensive Odoo Accounting app stands out.

Features of Odoo

- Odoo Accounting offers a double-entry bookkeeping system.

- It gives real-time reports to manage and track your finances.

- The software can handle multiple currencies for international transactions.

- A customizable dashboard allows you to have the controls as per your needs.

- You get automated bank feeds and reconciliation.

Pros of using Odoo

- User-friendly Interface: The interface is visually appealing and easy to navigate even for new users.

- Multi-Lingual Support: Supports multiple languages which benefits businesses with international transactions.

- Large Community: A large community of users helps in quick problem-solving through forums or online chat support.

- Open Source: It’s free as it is based on an open source platform which means no additional costs involved in purchasing a license or subscription charges.

- Scalability: It easily scales up as per need as the number of users increases

Cons of using Odoo

- Limited Customization Options: Not much room for personalizing the user interface or reports

- Limited Third-Party Integration: Does not allow integration with many third-party applications

- Complex Setup: First-time setup can be complex due to a large number of options

- Expensive Premium Version: To access additional plugins or features one has to purchase the expensive premium version

- Steep learning curve: Might be difficult at first, particularly for those who are new in this field

Also Read: Top 14 Trucking Accounting Software Picks!

8. Wave

Wave Accounting offers an excellent option for freelancers and small businesses looking for free bookkeeping software with integrated invoicing & receipt scanning capabilities.

Features of Wave

- Wave allows you to track income and expenses, manage invoices, and scan receipts.

- It offers double-entry accounting for accurate record keeping.

- The software syncs with your bank accounts and credit cards.

- A dashboard gives you a quick overview of your finances at a glance.

- Generate a variety of reports to analyze how the business is doing.

Pros of using Wave:

- User Friendliness: It’s designed for people who don’t have any prior accounting knowledge

- Unbeatable Price: The basic bookkeeping tools come for free

- Seamless Integration: Can sync with bank accounts or other financial tools like PayPal or Etsy

- Simple Setup: Quick and easy setup reduces time spent in putting up details

- 24/7 support: Anytime support adds to convenience

Cons of using Wave

- Limited Features: While it’s free, it does not offer advanced features like project tracking or inventory management

- Less customizability: Cannot modify invoice designs beyond certain limits

- Late responses: Despite 24/7 support, users reported delayed responses from the team

- No mobile app: There is no dedicated mobile app which restricts on-the-go usage

- Slow interface: Some users report the application interface to be slow

9. Methodology

The Methodology bookkeeping software solution uses automation to streamline bookkeeping tasks hence making it more efficient.

Features of Methodology

- Automatic transaction categorization makes bookkeeping easier.

- It offers cash flow projections based on past data trends.

- The reminder system helps you stay updated about upcoming payments or dues.

- Track sales and expenditures under different categories for easy analysis.

- Budgeting tools can help plan future finances.

Pros of using Methodology

- User-Friendly Interface: Easy-to-use interface means less learning time

- Real-time Updates: Real-time syncing with bank transactions for timely updates

- Projected banner: An ever-present banner offers projections about where you stand financially

- Automated tasks: Automation assists in reducing manual errors and speeds up the tasks

- Customer support: 24/7 customer support makes it easy to get help

Cons of using Methodology

- Limited features: Despite being paid, lacks various standard features like recurring invoicing

- Inefficiency in categorizing: Automatic transaction categorization is not always accurate

- No multi-currency compatibility: Cannot handle international transactions due to single-currency operations

- Not Mobile Friendly: Cannot access all features on mobile platforms

- Costly than competitors: Comparatively higher pricing as compared to other software offering similar features

10. QuickBooks

When I think about bookkeeping software, QuickBooks easily comes to mind. It’s designed with small and mid-size businesses in mind and offers a wide range of features.

- Features

- User-friendly interface: Its simple user interface makes data entry quick and easy.

- Invoicing: With QuickBooks, I can create professional invoices and track them easily.

- Expense tracking: The software allows me to connect my bank account for automatic updates.

- Report generation: From profit and loss statements to balance sheets, QuickBooks can generate several essential reports.

- Integration with third-party apps: This flexibility means it works efficiently with other applications like PayPal.

Pros

- Simplicity: The structured dashboard is straightforward which makes tasks easier for the users, including myself!

- Complete solution: QuickBooks provides all necessary accounting tools under one roof.

- Reliable customer support: As a user, I’ve found their customer service extremely useful when I’ve faced issues or had queries.

- Enhanced security: Rest assured knowing your financial data is secure with this software.

- Time-saving feature: Automated features like recurring invoices save me a lot of time.

Cons

- Since it provides numerous features, getting used to the platform can initially be confusing.

- The pricing plans could be higher than some other available software options out there.

- Since it offers customization options for invoice design, using those requires learning too!

- It may take longer than expected to sync large files on cloud storage sometimes.

- While there are various customization options available they might not always meet specific individual business needs.

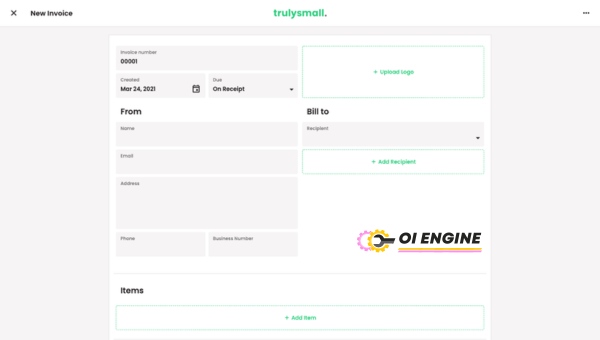

11. TrulySmall Invoices

Another excellent option that fascinates me due to its simplicity is TrulySmall Invoices; despite being simple it offers many surprisingly robust features.

Features

- Invoicing: TrulySmall allows me to invoice in any currency and accepts online payments.

- Financial reports: It helps generate useful financial reports like Profit/Loss statements.

- Expense tracking: It accurately keeps track of my expenses and categorizes them.

- Integrations: I find it great that this software easily integrates with various other applications.

- User-friendly interface: The software has a clean interface, making it easier to navigate.

Pros:

- Being able to track the status of invoices is particularly useful, letting me know when customers have viewed or paid an invoice.

- Its structure makes tax time much more comfortable

- Multi-currency support makes international invoicing hassle-free. This is very beneficial for global businesses like mine!

- With advanced security measures, I feel confident that sensitive information is safe.

- A cloud-based system means that I can access my data from anywhere!

Cons:

- Limited integrations compared to other software options available in the market.

- Despite being straightforward to use, it still requires some learning curve initially..

- For businesses with more complex needs, this may not be the most comprehensive solution.

- No inventory management feature proves challenging sometimes..

- No dedicated mobile app can be restricted when needing remote access.

Also Read: Unleashing Top 10 PEO Services For Smooth Sailing

12. Xero

Xero is mainly due to its wide array of functions suited for small-to-medium-sized businesses.

Features

- Invoicing module: With Xero, personalized and professional invoices are a breeze!

- The Bank Reconciliation feature keeps bank transactions updated automatically.

- The dashboard displays all vital accounting details at once making it easier for users like myself!

- MExpense claims keeping track of personal expenses is a piece of cake for employees.

Remote access lets me manage everything from anywhere.

Pros:

- Its intuitive design provides an easy-to-understand platform for managing finances.

- Real-time data tracking enables prompt decision-making.

- Around-the-clock customer support helps me resolve any issues immediately.

- Seamless integration with over 700 third-party apps is a significant plus point.

- The cloud-based system ensures easy access and secure data storage

Cons:

- Although it offers a wide variety of features, using all of them requires some learning curve.

- Limited customization options compared to its competitors might disappoint some users like me!

- Transfers between companies are not handled a bit clumsily in Xero at a time.

- There’s no phone support which could be inconvenient for users who prefer verbal assistance..

- Pricing can seem more expensive as compared to other available bookkeeping software.

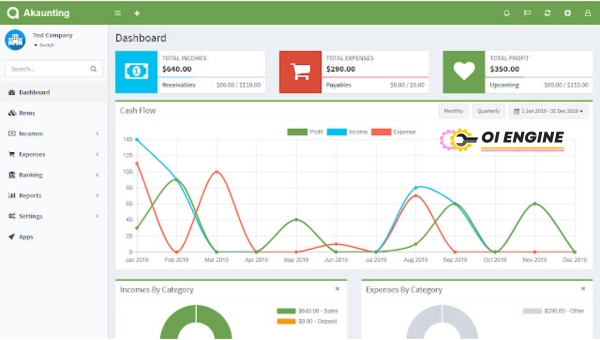

13. Akaunting

Akaunting is a comprehensive and easy-to-use bookkeeping tool that I’ve found especially helpful.

Its features include:

- Over 50,000 users worldwide, showing its reputation and reliability.

- An online accounting function that allows users to manage invoices, expenses, and bank accounts in one place.

- A free version with a very apt set of features for small businesses.

- A multilingual interface including over 45 languages makes it even more convenient.

- It offers real-time updates on sales activities.

However, every tool has its pros and cons. In my experience:

Pros:

- The user-friendly dashboard provides me with an instant overview of my business finances.

- Customizable invoices help in building a professional image for my company.

- Data backups ensure safety and avoid potential losses.

- Its product is mobile-optimized which means I can manage everything on the go.

- It supports multiple currencies useful for international business transactions.

Cons:

- The free version lacks advanced features like reports or tools for managing tax returns.

- Base currency can’t be changed once the account is setup

- The interface might seem complicated initially to those unfamiliar with accounting software.

- There’s no customer support available for the free version if you run into conflicts or issues requiring assistance.

- Fewer integrations are offered compared to some other accounting software

14. Sunrise

Sunrise – is another great tool I recommend.

Some remarkable features are:

- Sunrise organizes income, expenses, payments, and invoices cohesively in one dashboard providing clarity at a glance

- It allows connecting your bank account directly which simplifies finance management drastically

- Utilize its pre-built invoice structure to charge clients rapidly

- The tax assist function calculates precisely how much tax you owe

- Expert accounts review functionality enables expert review of your books

Pros :

- Using Sunrise, I’ve found the clean interface quite easy to navigate

- With built-in payment processing, getting paid is a breeze

- It has an online booking system which improves client servicing

- Customer support timely resolves any issues encountered

- It’s mostly ad-free, presenting a clutter-free working environment

Cons :

- Limited third-party integrations can limit its utility for some businesses

- Although user-friendly, it may take time initially to familiarize with the functions

- A few advanced features require you to upgrade to a paid plan

- Slow speed at times can lead to slight inconveniences

- Limited customizability of invoices

These free bookkeeping software options are set to help many businesses align their financial activities more effectively in 2025.

Each one has unique traits that can potentially save time and money while making the bookkeeping process more organized and efficient.

After all, effective bookkeeping is paramount to a thriving business. With these tools at your disposal, financial management will become easier than ever in 2025.

FAQs

Is there a free bookkeeping program?

Yes, there are several free bookkeeping software available. They include ZipBooks, Wave Accounting, Zoho Books, and GnuCash among others.

What is the easiest bookkeeping software to use?

Among the various options available, I find Wave Accounting and ZipBooks relatively user-friendly. Their intuitive design is perfect for non-accountants who need a simple solution.

Is ZipBooks free?

Yes, ZipBooks offers a basic version that is completely free. While it does have premium versions with more features at an additional cost, the free version provides enough functions for basic bookkeeping needs.

Can I use Excel for bookkeeping?

Absolutely! Excel has many financial templates you can use for budgeting and accounting. However, it lacks advanced bookkeeping features found in specialized software like Zoho Books.

Also Read: Unlock Postal Productivity With Postage Meters

Conclusion

After exploring various options, I can confidently say that in 2025, the saving grace for many small businesses and freelancers has been the emergence of high-quality Free Bookkeeping Software.

I’ve shuffled through numerous platforms, but it’s clear that ZipBooks, GnuCash, Wave Accounting, Zoho Books, FreshBooks, and NCH are standing firm as the best free bookkeeping tools.

These platforms provide incomparable features that efficiently simplify financial management.

So if you’re grappling to handle your books or searching for financially feasible solutions – any of this bookkeeping software would make a great pick! My advice is to explore each one of them before making your choice.