Getting your hands on a free business checking account that offers essential features without leaving you at arm’s length for avoidable costs can be exhilarating.

I have been in those shoes, engaging in endless searches, and comparisons, and sometimes having a taste of disappointment.

The good news is that I discovered top free business checking accounts capable of serving different classes of entrepreneurs at their points of need.

So, what are these top 16 free business checking accounts? They are Ramp, Chase, Axos Basic Business Checking, Novo Business, Relay, Bank of America, Bluevine Business Checking, Nbkc business account, and Brex Cash among others.

These financial platforms have displayed proven records and sustained reputations for reliability and suitability to various scales of businesses.

16 Best Free Business Checking Accounts

When it comes to choosing the best free business checking accounts for my enterprise, I certainly want a deal that works best for my specific needs.

There are numerous options available out there, and it could be tricky picking one given their unique offerings.

Let’s take an in-depth look at some of the best free business checking accounts so you can decide which account fits your business needs.

1. Ramp

Ramp is another impressive alternative, offering a business credit card with various competitive features.

If your business primarily relies on debit and credit transactions, you might find a good fit here.

- Best Feature: Ramp’s built-in bookkeeping insights are its standout feature. It provides detailed, automated financial reports essential for any growing business.

- Monthly Fee: Information about Ramp’s monthly fees isn’t specified online – it’s always best to clarify these points when considering a new account.

- Transaction Fee: Again, specifics regarding transaction fees are not clearly stated online; getting in touch with the provider for more information is the safest course.

- Cash Back: One notable aspect of Ramp is that they offer a 1.5% cash back rate on all card spending – an excellent perk for businesses that frequently use their cards!

- Additional Features: No annual or foreign transaction fees and automated accounts payable services are just some of the additional features that make using Ramp so beneficial.

- Downsides: Good things often come with small drawbacks: in this case, to apply for a card from Ramp, you’ll need to maintain a minimum account balance of $75k. Furthermore, if you’re operating as a sole proprietorship, you won’t be able to apply.

Also Read: Car Hauler Insurance: Secure Your Transport

2. Chase

When it comes to highly reputable banking establishments with quality service and diverse offers; Chase Business Complete Banking may be your go-to option.

- Best Feature: Chase stands out for its perk of no ATM or debit card transaction fees — an incredibly useful feature if such transactions form part of your daily operations!

- Monthly Fee: On paper, there’s a $15 monthly fee – however, if you manage to maintain at least $2K in your account balance every day (or meet one of their other criteria), this fee will be waived.

- Transaction Fee: While specifics about non-card transaction costs aren’t easily available, their website should provide such information.

- Additional Features: With Chase, you’ll enjoy an extensive network of ATMs and branches across the country. Plus, if you’re a new customer, you’ll receive a $300 bonus just for opening an account with them!

- Downsides: Unfortunately, maintaining a minimum balance may pose challenges for smaller businesses or startups. There may also be fees over and above your monthly charges if certain categories of transactions exceed a given number or dollar amount – getting all the fine print laid out will be key.

3. Axos Basic Business Checking

Axos Basic Business Checking is another excellent choice for a free business checking account. Designed with small businesses in mind, Axos Basic offers a range of advantageous features that make financial management more straightforward.

- Best Feature: Axos stands out by providing unlimited fee-free transactions, allowing businesses more freedom and flexibility with their transaction needs.

- Monthly Fee: No need to fret about monthly fees with this bank account. The Axos basic business checking account comes without any monthly charges, thus remaining light on your wallet.

- Transaction Fee: Just like its generous offering of no monthly fees, this bank also offers free transactions thereby relieving you of any additional costs!

- Additional Features: Other perks include an online banking platform compatible with QuickBooks® for easier accounting integration. Moreover, you get access to their nationwide ATM network along with free first checks on opening an account.

- Downsides: Although being purely online ensures accessibility and control from anywhere anytime, the lack of physical branches may be a drawback for businesses who prefer face-to-face banking experiences or need immediate assistance.

4. Novo Business Checking

Novo is yet another strong contender on our list of free business checking accounts. This digital-first platform offers powerful features for entrepreneurs looking to take their business finance management to the next level.

- Best Feature: One standout feature of Novo is its seamless integration with other fintech platforms like Stripe, QuickBooks, and Google Pay. It does a facile job of meshing your bank account with such tools thus making digital transactions a breeze.

- Monthly Fee: Free from any monthly fees, a Novo account offers an economical and efficient financial solution for your startup or small enterprise.

- Transaction Fee: Furthermore, there are no transaction fees involved – a bonus that can save businesses considerable amounts in the long run.

- Additional Features: Alongside these benefits, Novo also refunds ATM fees globally – something quite uncommon among other banks. The ability to organize all deposits with tags and notes and apply them directly to invoices is another handy capability.

- Downsides: Despite many strengths, Novo falls short in supporting cash deposits; it isn’t able to accommodate this need as everything requires an online approach. Notably regardless of being technologically driven, there’s no offering of interest returns on account balances which might be important for some users.

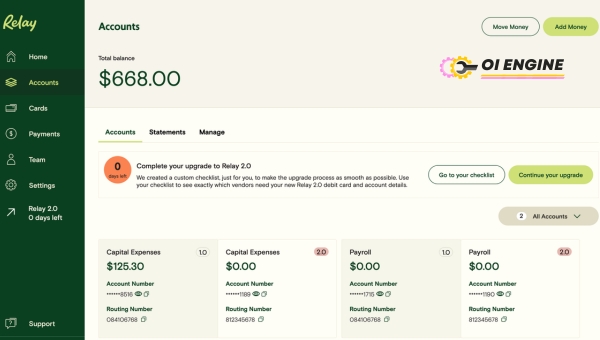

5. Relay

Relay offers a digital business checking account that promises a hassle-free banking experience. Being an entirely online platform, it provides convenience and ease of use for busy business owners.

- Best Feature: Touted as a smart corporate card, Relay prides itself on various features like auto bookkeeping and collaboration tools designed to simplify your financial operations.

- Monthly Fee: With Relay, you’ll never have to worry about monthly fees – because there aren’t any! This way, more of your money can stay right where it belongs: with your business.

- Transaction Fee: Just like its absence of monthly fees, Relay also offers free transactions. One less worry on your plate!

- Additional Features: Aside from its basic banking operations, Relay also integrates with popular accounting software, streamlining the process of managing your finances and thereby saving you valuable time.

- Downsides: Because they provide only an online service, cash deposits are not supported – this may pose a challenge if your business needs to handle physical cash regularly.

Also Read: Top 14 Trucking Accounting Software Picks!

6. Bank of America

Banking giant Bank of America is renowned for its extensive services catering not to just individuals but small businesses as well.

- Best Feature: Bank of America’s Business Advantage Checking Account provides robust features such as merchant services and high-grade security measures – all essential elements for running successful businesses in today’s digital landscape.

- Monthly Fee: Although not free per se – the monthly maintenance charge can be waived if certain qualifiers are met such as maintaining a minimum daily balance or qualifying credit card transactions.

- Transaction Fee: The Transaction fee varies based on the type and frequency, but some transactions are included for free each month before additional charges apply.

- Additional Features: Among other features is access to their global ATM network so you can handle banking errands while abroad without extra stress besides toll-free customer support around-the-clock ensuring help is always just one phone call away.

- Downsides: Fees apply if you exceed the limit of the number of transactions in a month.

This combination of standard business needs with advanced features puts Bank of America’s business checking account among one of the best.

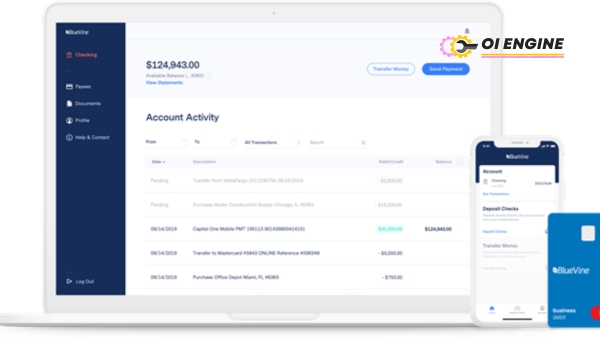

7. Bluevine Business Checking

The Bluevine Business checking account is a fantastic option that offers both high interest rates and no fees, making it an affordable choice for businesses.

- Best Feature: Notably, Bluevine Business Checking offers high interest rates at 2.0% on balances up to $250k.

- Monthly Fee & Transaction Fee: Are you tired of hidden bank charges eating into your profits? With zero monthly fees or transaction fees, BlueVine lets you keep more of your hard-earned money.

- Additional Features: To bring more convenience to your banking experience, this account supports mobile check deposits and also integrates with popular accounting systems like QuickBooks, PayPal, and Stripe. No worries about cash deposits either since this account handles up to $7,500 per month! And did I mention they are FDIC-insured up to $3,000,000?

- Downsides: Despite the benefits that come with it, one primary limitation to note is no physical branches are available as all services are online. This can be inconvenient for businesses that rely heavily on face-to-face interactions or cash operations.

8. Nbkc business account

If you’re searching for a business checking account that offers convenience with minimal fees, the Nbkc – or National Bank of Kansas City – business account might just be your ideal fit.

- Best Feature: The most wonderful thing about this is its freedom from unnecessary charges. There are no transaction fees, no minimum balance requirements, no overdraft or returned item fees!

- Monthly Fee: Expectedly, monthly service charges are also not part of their deal. So you’ll get to enjoy a free checking service without having to worry about any hidden costs.

- Additional Features: Apart from these essentials, the online bank platform integrates well with other digital tools like QuickBooks, and Wave accounting software and has bill pay options too. Money Pass ATM network access is also granted free of charge! And for your peace of mind? This account is FDIC-insured up to $250,000.

- Downsides: Unfortunately though, despite all these amazing features, one limitation that comes across as a disadvantage to some businesses is the lack of physical branches. But remember if your operations are mostly online – this shouldn’t be an issue at all!

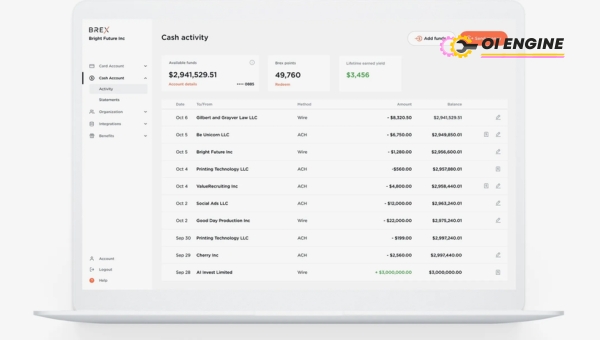

9. Brex Cash

Brex Cash is another impressive business checking account that caters to tech companies, eCommerce businesses, and other B2B companies.

- Best Feature: Brex Cash allows businesses to earn points on every dollar spent using their account. These points can be redeemed for travel rewards or transferred to various partner reward programs – this feature makes it stand out amongst other business checking accounts.

- Monthly Fee: Similar to Relay, Brex doesn’t charge any monthly fees, giving a significant saving for your business.

- Transaction Fee: Transaction fees? None. With Brex Cash you enjoy the freedom of making endless transactions without any added charges.

- Additional Features: Handy extras include instant payouts when doing business with Shopify and automatic syncing with Quickbooks. Plus, with no minimum balance requirements, it’s suitable for startups and small businesses too.

- Downsides: While they offer a host of benefits, one major downside is that they don’t support cash deposits. Moreover, while ideal for tech-savvy companies, less technical ones may find their specialized features overwhelming.

Also Read: What is Double-Entry Bookkeeping In Accounting?

10. Grasshopper

Grasshopper is a unique blend of phone systems and banking services designed primarily for entrepreneurs and small businesses.

- Best Feature: One of the best features offered by Grasshopper is their cash-back feature! For every purchase made using your Grasshopper card at designated merchants you get some money back – now talk about a deal!

- Monthly Fee: As with our previous mentions no monthly fee here! Who wants extra charges anyway?

- Transaction Fees: Hold onto more of your hard-earned money – at Grasshopper there are zero transaction fees attached!

- Additional Features: What sets them apart? Their digital platform allows you to open an account in as little as five minutes. It also boasts integration with Quickbooks and the provision of FDIC insurance up to $250,000.

- Downsides: One of the limitations with Grasshopper is that they don’t provide cash deposits which can be a deal-breaker for some businesses.

11. Huntington 100 Checking

For smaller businesses, the Huntington 100 Checking account might just be the perfect fit. This account accommodates businesses with lower transaction volumes and balances.

- Best Feature: One advantage of the Huntington 100 Checking account is its overdraft protection. Now you won’t have to suffer sleepless nights worrying about getting charged for overdrawing on your business checking account.

- Monthly Fee: With this unique free business checking option, you won’t have to deal with any monthly maintenance fees! Consider it one of the simplest ways to save money in your business operations.

- Transaction Fee: Businesses usually need more transactions daily, so you’ll be delighted that there are no transaction fees here.

- Additional Features: The Huntington 100 Checking also offers customers free email alerts regarding their account activities; These alerts can notify you about significant transactions or any sudden changes related to your accounts.

- Downsides: However, a major downside may be that it only allows for up to 100 monthly transactions — therefore larger businesses may find this limit restricting.

12. Lili

If you’re self-employed or running a small operation, Lili could be an excellent choice when choosing an online-only free business checking account. This account is geared towards freelancers and independent contractors who run a one-person shop.

- Best Feature: Lili stands out with its invoice tracking system which is extremely detailed and offers real-time updates on your income.

- Monthly Fee & Transaction fee: What’s more appealing is that there are no monthly fees or transaction charges in sight!

- Additional Features: Another excellent feature is its simple-to-use app which comes with an intuitive interface and ease of navigation. Additionally, Lili offers expense management tools that help users conveniently categorize their expenses for easier tax preparation.

- Downsides: Unfortunately, there’s limited support for cash deposits because it operates primarily online. Also, be aware that there are no outgoing wire transfers allowed.

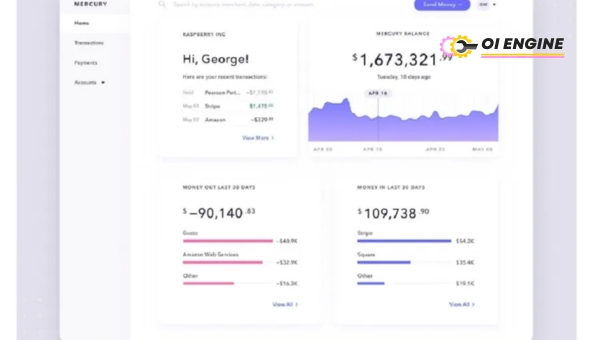

13. Mercury Banking

For businesses that rely on technology and modern solutions, Mercury Business Checking could be the answer.

It provides seamless banking operations with a heavy emphasis on integration with other platforms.

- Best Feature: On top of regular banking services, Mercury Banking provides venture debt services. They are created with tech companies and startups in mind.

- Monthly Fee: With no monthly fee, using money to pay for your checking account isn’t a concern you’ll have here.

- Transaction Fee: Transactions also come free of charge, helping businesses keep extra expenses at bay.

- Additional Features: One unique feature that makes Mercury Banking stand apart is its API access. This feature can integrate your bank account directly into your business operations for added convenience. The application process is also streamlined to ensure setting up an account can be done with minimal hassle.

- Downsides: Unfortunately, traditional cash deposits aren’t supported, which might be a deal-breaker if you frequently handle cash in your business operations. Additionally, their APY (Annual Percentage Yield) on savings accounts is relatively low compared to some competitors.

14. Wells Fargo

Wells Fargo is a household name in banking, and it brings its experience and solidity to free business checking accounts. Its comprehensive offerings make it suitable for businesses of all sizes.

- Best Feature: What stands out with Wells Fargo is its wide access to both online services and physical branches. This makes banking a breeze whether you operate digitally or require face-to-face banking services.

- Monthly Fee: While not entirely free, the monthly fee can be avoided with a modest minimum daily balance or qualifying transactions.

- Transaction Fee: Charges on transactions depend on your account activity but can be avoided with specific conditions.

- Additional Features: Unlike many of its counterparts, Wells Fargo offers an overdraft protection plan. It ensures that even when things go wrong financially, your bank has got you covered.

- Downsides: It’s vital to note that although this checking account may technically be classified as free, several terms must be met to avoid fees. Therefore, if your business can’t guarantee meeting those conditions consistently every month, other options might suit you better.

15. DCU (Digital Federal Credit Union) Business Checking

The Digital Federal Credit Union, or DCU, offers a combined online and in-person banking experience.

With a free business checking account, it is a great choice for businesses looking for financial services with flexibility.

- Best Feature: DCU is unique in offering both online and in-person services. Having physical locations as well as ATMs can be reassuring if you enjoy the option of face-to-face banking assistance.

- Monthly Fee: As part of this list, it’s no surprise that there are no monthly fees attached to using their business checking account.

- Transaction Fee: The picture is just as rosy when it comes to transaction fees – there are none!

- APY: You have the chance to earn through your balance too – DCU offers an APY of 0.10%.

- Additional Features: Among its various other features, unlimited check writing might be particularly useful if your business still uses checks regularly. Additionally, the account carries FDIC insurance up to $250k which helps ensure your money’s safety.

- Downsides: It does come with some drawbacks though. There are fees for making over 20 daily deposits and membership is limited by region and organizational affiliation.

Also Read: How To Start A Trucking Company: A Guide

16. Capital One

Capital One offers a business checking account designed to support growing businesses. With several beneficial features, it invites you to do more with your money.

- Best Feature: The absence of transaction limits is one of the major advantages of the Capital One business checking account, allowing you stress-free banking.

- Monthly Fee: There’s no monthly fee with the minimum balance condition met.

- Transaction Fee: No transaction fees! You can make unlimited electronic transactions without worrying about extra charges.

- Additional Features: The convenience continues with free cash deposits up to $5k and 70k fee-free ATMs throughout the U.S. Also, they offer an overdraft protection feature, offering peace of mind in case your balance falls short unexpectedly.

- Downsides: However, it does have some downsides like an initial requirement of $250 as a minimum opening deposit amount and availability limited to only certain states.

FAQs

What business bank account has no fees?

Several business bank accounts come with no monthly fees. These include the Axos Basic Business Checking, Novo Business, Relay, Bluevine Business Checking, and many others listed in my guide to the 16 best free business checking accounts.

Can I open a business checking account with no money?

Yes, you can. Certain banks like Lili and Novo do not require a minimum deposit to open a business checking account. However, some other banks may demand an initial deposit.

Are business bank accounts free?

Not all but numerous are indeed free. Banks such as Axos Basic Business Checking, and Relay offer their clients Free Business Checking which implies there’s no monthly fee involved.

What is a small business checking account?

A small business checking account is designed for businesses with fewer transactions and lower balances. It provides necessities including check-writing capacities, and debit cards for employees, and serves as a separate financial focal point for managing and tracking your small business’s cash flow.

Do I need a business bank account for sole proprietorship?

While it’s not legally required by all means it’s often recommended because it helps separate personal finances from your firm’s assets which can be handy during tax season or if legal issues ever arise.

Conclusion

Exploring free business checking accounts is a crucial aspect of sound financial management. Each option summarized here offers specific benefits tailored to different business needs.

Although certain limitations exist, like a lack of physical branches or low return on savings, the essential element remains – their affordability.

Going through this list would enable you to compare and contrast these options effectively. Remember that choosing the right bank for your business does not only involve weighing fees against benefits; it also depends heavily on what fits your company’s operational necessities best.