Rightly said, the heart of every successful business is an efficient bookkeeping system. That could not be any truer for the trucking industry. I’d say, that if you are involved in the trucking business, mastering trucking bookkeeping could open new doors of prosperity and growth for you.

But how can you possibly do that? You may ask. After all, with expenses at every road turn and complex routes, keeping track can be overwhelming.

Let’s take a deep breath here—what if I tell you there’s a way around it? With just a few strategic tweaks in your current bookkeeping approach, getting your finances on track could be as seamless as cruising on an open highway.

After meticulously traversing through numerous strategies and narrowing them down to key pointers—I have highlighted the top 10 must-know tips to master trucking bookkeeping!

10 Essential Tips to Master Trucking Bookkeeping

In the world of trucking business, keeping track of your finances can seem like a daunting task. But don’t fret; mastering trucking bookkeeping is doable with some guidance and consistency.

I’ve gathered ten essential tips that can help simplify this process for you.

1. Stay current with your records

One of the first steps towards successful trucking bookkeeping is staying current with your records. This means regularly updating and checking all financial documents and transactions.

Leaving it for too long could lead to confusion or even worse, errors that might cause you to lose money. I ensure that I dedicate a few hours every week or pay period depending on my workload, just to update my books. Doing this makes tax time a breeze and helps me feel more in control of my business’s finances.

Further, having updated records offers me an accurate view of my company’s financial health at any given moment in time.

This allows me to make informed decisions about spending, saving, or investing based on real-time information rather than guessing or estimating how much money is flowing into and out of the business.

Also Read: Autonomous Trucking Revolution: The Future Rides On AI

2. Take detailed notes.

Taking detailed notes is also essential in trucking bookkeeping. Whether it’s jotting down specific expenses during a route or logging work-related purchases made throughout the day, every little bit counts when it comes to tracking your finances accurately.

Keeping close tabs on daily activities ensures that no details slip through the cracks when managing your accounts later on – believe me, it’s easy for small transactions to sneak past if they’re not recorded immediately!

By noting down everything as soon as possible (even if it seems insignificant at first), you’ll have a comprehensive record that will prove invaluable in both short-term budgeting and long-term financial planning operations.

3. Utilize a business credit card

Running a trucking business involves many variable costs, from fuel prices changing every day to unexpected vehicle repairs.

For this, I use a business credit card. By keeping all of my business expenses on one card, it is much easier to keep track of expenditures and make sure everything gets captured in my books accurately.

In addition, many business credit cards offer reward programs that can help save money in the long run – the key is to pay off the balance each month to avoid interest charges as they put unnecessary pressure on your profitability.

4. Be aware of your cost-per-mile.

Understanding how much every mile costs in your trucking operation can be eye-opening. This involves factoring in fixed costs like insurance and loan payments along with variable costs like fuel and maintenance.

Once you’ve worked out how much each mile costs you to drive, it becomes easier to set competitive prices for jobs without undervaluing your services or losing out on potential profit.

Monitoring cost-per-mile also helps me identify any areas where savings could be made – perhaps by improving fuel efficiency or negotiating better rates for truck maintenance or loan repayments.

It’s a vital metric for any operator looking to maximize their earning potential from trucking bookkeeping.

5. Minimize your DSO (Days Sales Outstanding)

One of my cardinal steps to mastering trucking bookkeeping revolves around minimizing my Days Sales Outstanding (DSO).

DSO refers to the average number of days it takes for a company to collect payment after a sale has been made.

A lower DSO means quicker cash inflows, which helps in better management of daily operations including fuel purchases and maintenance costs.

I need to take proactive measures such as issuing invoices promptly and enforcing stricter payment terms with customers.

This not only ensures that I have cash moving into my business at an adequate pace but also minimizes any chance of delinquency from the customers’ end.

Also Read: 15 Best Commercial Truck Insurance – Top Providers Revealed

6. Employ suitable accounting software

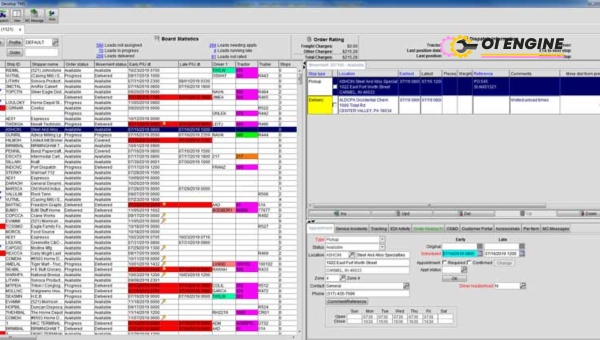

When it comes to managing my trucking finances, finding and utilizing appropriate accounting software has been incredibly helpful.

It simplifies tracking income sources, expenses, taxes, and more into an easily digestible format. There’s no doubt that proper software can make a difference in managing your money more effectively.

I evaluated several options before deciding on one that catered best to my company’s needs—it should be easy to use yet comprehensive enough to cover all aspects related to trucking bookkeeping such as mileage tracking or managing freight bills among other features.

Once integrated with daily operations, you’ll find much easier navigation through financial landscapes day by day.

7. Segregate personal and Business Expenses

One thing I’ve learned over years running the trucking business—it’s crucially important to keep your personal and business expenses separate. Mixing these two not only makes your bookkeeping a nightmare but might also bring you under unwanted scrutiny from the tax authorities.

I found it helpful to maintain different credit cards and bank accounts for my trucking business, away from my finances.

This allowed me to track all of my business expenses neatly in one place without any confusion between personal and professional outflows.

By keeping everything separate, I found that insights regarding profitability or areas of heavy expenditure became clearer, helping me make more informed decisions about ways to improve business profitability.

8. Thoroughly Track Fuel Expenditures

One of the most significant expenses in trucking companies is fuel cost. Hence, it is important to monitor fuel expenditures thoroughly.

Carefully taking records of every earlier purchase and saving every fuel receipt is my first step towards this.

After collecting the receipts, my next task becomes to input these records into an accounting software or a spreadsheet, whichever suits me better.

The key here is to stay consistent in recording such expenditures promptly rather than doing a lump sum entry at the end of the month or quarter. This aids in better management and analysis of fuel consumption trends and costs.

Furthermore, I always ensure that I reconcile these entries against claims made by drivers or any digital tracking system used. Any discrepancy identified early will help prevent major issues down the line.

9. Keep a Close Eye on Maintenance Costs

Trucking business has its fair share of wear and tear which leads to inevitable maintenance costs. Like any other expenditure, recording every penny spent on maintaining trucks efficiently has helped me manage these costs better.

Every time my trucks go for servicing or repair work, I diligently record them as soon as possible. Doing so ensures that none of such expenses are missed out from being included in books.

Moreover, keeping track regularly allows me to understand patterns — when are costs peaking? Are some trucks breaking down more often? Is there a correlation between breakdowns and routes taken?

These questions provide invaluable insights into managing your fleet more efficiently saving not only money but also improving operational efficiency.

10. Regularly Reconcile Your Accounts

Managing books is not just about recording transactions; it’s also about validating these entries periodically. One technique I use for this purpose is regularly reconciling my accounts.

When I speak about regular reconciliation, it entails a thorough comparison of my internal records with external data sources such as bank statements or vendor invoices. It’s a good way for me to be sure that all transactions have been recorded accurately.

Reconciling your accounts and comparing the two sets of records helps you catch errors early, whether they’re made by you, your employees, or your bank.

Discrepancies might be due to many factors like missed entries, double accounting, unauthorized transactions, etc.

Reconciliation should be carried out regularly — at least once a week — rather than as a monthly activity. By doing so, I manage to catch issues sooner and action can be taken promptly before it affects other aspects of business operations or cause financial loss.

FAQs

What does a bookkeeper do for a trucking company?

A bookkeeper manages all financial records for a trucking business. This includes tracking income and expenses, handling invoices, managing payroll, and ensuring compliance with tax regulations.

What are the accounting responsibilities of a trucking company?

Accounting responsibilities for a trucking company include managing income and expense accounts, tracking costs per mile, monitoring fuel expenditure, segregating business and personal expenses, and regularly reconciling accounts.

How do you categorize trucking expenses?

Trucking expenses can be categorized into various categories like maintenance costs, fuel expenditures, employee salaries or wages, licensing fees, and insurance premiums. It’s essential to keep track of each category to help manage your finances more efficiently.

What records should you keep for a trucking business?

Keeping detailed records is vital in the trucking industry. These include income statements, expense receipts like fuel bills or maintenance invoices, and logbooks detailing mileage driven and deliveries made among other information important in Trucking Bookkeeping.

Do truckers need bookkeeping?

Yes! Conductive bookkeeping is crucial in any business including the trucking industry. It helps in effectively managing finances while ensuring taxation compliance which ultimately leads to success in the long run.

Also Read: Truck Driver Salary By State: Unveiling The Payday Secrets

Conclusion

Mastering the aspects of trucking bookkeeping might seem daunting initially, but with the right tips at your disposal, it’s certainly manageable. Taking steps such as staying current with your records, being mindful of your cost-per-mile, and regularly reconciling your accounts can prove instrumental in improving your financial records.

As I introduced effective practices like utilizing a business credit card and employing suitable accounting software, you will save both time and avoid possible errors that could impact your bottom line.

Don’t forget to segregate personal expenses from business ones for accurate financial reports. Lastly, meticulous tracking of fuel expenditures and maintenance costs contributes to more profitable operations.

Following these tips will surely lead you towards better finance management in the trucking industry.