Ever caught yourself wondering, “What is bookkeeping?” or heard the term being tossed around in financial circles and amid business talks? Well, don’t sweat it because you’re not alone.

Plenty of people are asking the same question! This has attracted a great deal of curiosity and for a good reason.

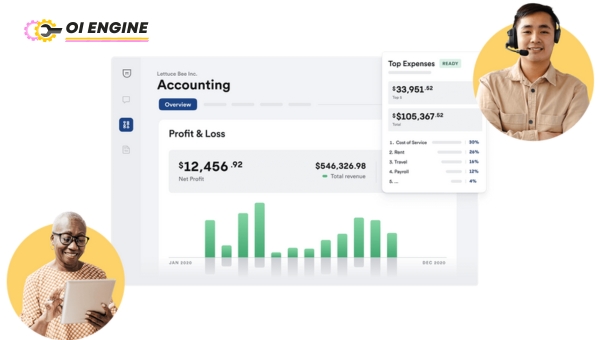

Bookkeeping is an integral part of finance. Essentially, it involves recording a company’s financial transactions on a day-to-day basis.

It’s an accounting process that allows businesses to keep track of their income and expenses which further aids in evaluating profitability and maintaining regulatory compliance.

What Is Bookkeeping?

In the simplest terms, bookkeeping is the method of recording and organizing all financial transactions within an establishment.

It’s like keeping a diary of your business’s financial activity. Whether it’s a small mom-and-pop store or a large multinational corporation, bookkeeping is crucial to managing funds properly.

Peeling back the layers, we discover that bookkeeping is key to painting an accurate picture of your company’s fiscal health.

Without an accurate reflection of incoming revenue and outgoing expenses, businesses can crumble faster than anticipated. Therefore understanding “What Is Bookkeeping?” becomes even more essential.

History Of Bookkeepers

Historical accounts illustrate that the practice of bookkeeping dates back as early as 2600 B.C.E during ancient Mesopotamian times when changing hands of cattle or crops were meticulously recorded on clay tablets.

Over centuries and across civilizations, the role has transformed considerably but its importance never faded. It formed the backbone for all trade activities.

Fast forwarding to our present-day scenario – with calculators replacing abacuses and computers taking over physical ledgers – our generation vests immense significance in digitized bookkeepers pivotal for maintaining economic orderliness in our society.

The Role Of A Bookkeeper

So what exactly does a typical day look like for a bookkeeper? Here are some daily tasks:

- Recording Financial Transactions: Every single penny coming in and going out needs to be documented accurately.

- Work on Financial Statements: Cumbersome paperwork like income statements or balance sheets is primarily handled by them.

- Bill Payments And Payrolls: Overlooked by many but without them managing these nuances we would be lost at sea!

- Bank Reconciliations: It involves matching the balances in an entity’s accounting records for a cash account to the corresponding information on the bank statement.

- Tax Preparations: Love it or hate it; this intricate process requires utmost precision – another mammoth task adeptly handled by bookkeepers.

In a nutshell, without the relentless efforts of these unsung heroes, any business establishment would find itself in dire straits.

Also Read: California Leads In EV Chargers, Struggles With Green Power

Why is Accountability Important in Bookkeeping?

Accountability in bookkeeping means making sure every penny that moves in and out of a business is recorded correctly.

Think of it like this: if you’re saving up for something big, you’ll want to keep track of how much money you have and how much you’re spending.

In business, it’s even more important because there’s a lot more at stake. When a bookkeeper does their job well, the company knows exactly where its finances stand. This helps everyone make better decisions because they have clear information to work with.

Being accurate and responsible for the finances also means that businesses can trust their numbers when it comes time to pay taxes or deal with loans.

No one wants to get into trouble for missing numbers or messing up their accounts. That’s why taking bookkeeping seriously – by being accountable – is key for any business, big or small.

Necessity of Accounts Receivable

Picture this: if a store sells goods but doesn’t keep track of who owes them money or when they’ll get paid, they might run out of cash while waiting.

That’s where keeping an eye on accounts receivable comes in! It’s all about recording who owes the business money after selling them goods or services on credit (which means they’ll pay later).

Knowing well what money should come in helps make sure there’s enough cash to keep everything running smoothly – like paying bills, buying new stock, and paying people’s wages. Precise records here mean no surprises when it comes time to collect.

Sometimes customers might be late paying what they owe or forget altogether! If records aren’t straight or are left un-updated, then these payments might slip through the cracks, making finances look stronger than they really are which can end up being quite harmful to a business’s health.

Emphasizing on Accounts Payable

On the other side of things is accounts payable — basically bills that need to be paid by the company itself. Staying sharp about accounts payable ensures that all debts owed by the business are known and settled timely.

Let me put it simply: just as anyone wouldn’t want unexpected bills popping up from nowhere; a business has got to prevent those kinds of shocks too!

By keeping tabs closely on every transaction ongoing as accounts payable dictates, businesses protect relationships with suppliers by preventing overdue payments which could result in stoppage of supplies or extra charges due to delayed settlements.

Errors and Omissions

Now imagine if someone forgot an important bill or skipped recording a day’s sales: suddenly the numbers don’t match up anymore – we call these issues errors and omissions!

Bookkeepers watch like hawks to catch mistakes before they turn into bigger problems because little goofs can lead to massive headaches later on if not noticed early – like underpaying taxes due because some sales were missing from your books!

Moreover, without careful attention, there could be duplicate entries confusing actual values leading once again to creation & dealing with situations becoming stressful plus costly owing to lack of diligence during record-keeping phases.

To Avoid Cash Flow Issues

Cash flow issues refer to maintaining a steady stream of money coming and going so there isn’t too much lying unused or shortages disrupting daily operations — think timing everything right here applicable financial movements make a difference in success and survival given the context of corporate endeavors

To steer clear of such dilemmas proper tracking of revenue expenditures enabled via conscientious practice allows spotting trends and predicting future fiscal requirements effectively aiding preparation against unexpected downturns always ensuring ready to take whatever challenge next brings forth maintaining solid foundations underlining enterprise’s overall survival growth paths forward chosen tread upon embarking journey corporate world awaits explore conquer compete therein successfully.

Also Read: Bookkeeping Tips: 19 Surefire Strategies for Financial Order

Dealing with Internal Issues Via Effective Bookkeeping

One of the essential dynamics of bookkeeping is dealing with various internal issues. Without efficient and effective bookkeeping, a business might face several challenges such as fraud, wage disparities, and erroneous tax filings.

Not only does this cause substantial financial loss, but it can also severely damage the reputation of a business.

On the other hand, lacking compliance with regulatory standards because of inadequate record-keeping practices could bring about fines or operational constraints.

Curtailing Internal Fraud, Wage, and Tax Issues

Proficient bookkeeping is your frontline defense against certain internal problems such as internal fraud, wage disparity, and erroneous tax filings. Let’s take a closer look at each:

- Internal frauds: These are dishonest activities conducted by employees or company insiders. Unexplained expenses, irregular transactions, or sudden changes in behavior are common red flags. Bookkeeping helps track every single penny spent in a business, ensuring there’s full accountability throughout your operations.

- Wage disparity: This involves paying certain staff members significantly less or more than others without reasonable cause. An efficient bookkeeper would maintain comprehensive salary records to prevent unfair compensation.

- Erroneous tax filings: Misreporting incomes or expenses can relative to serious implications from audits to significant penalties. Keeping accurate financial statements would ensure that the correct amounts of taxes are reported and paid in due time.

Without diligent record keeping to provide oversight into these areas of concern within your organization may give rise to unnecessary risks that otherwise could be mitigated.

Non-compliance Fears

Accurate records are critical for staying compliant with various business laws & regulations existent today like taxation legislation or employment laws – something referred to as “regulatory compliance”.

Adequate financial records capturing all monetary activities within an organization make it easier for businesses not just to meet their obligations promptly but also to prove their adherence if questioned.

An efficient bookkeeping system ensures you remain in the green by avoiding hefty fines and penalties that come with non-compliance.

It also contributes greatly to the strength of a business’s credibility in both industry and consumer eyes, leading to propelling its overall profitability.

Therefore, effective bookkeeping is more than just maintaining financial records – it’s about ensuring regulatory compliance, preventing disputes and disputes, and building a reliable business reputation.

Difference Between Casual Accounting And Expert-Level Bookkeeping

Casual accounting and expert-level bookkeeping might sound similar, but they are two different practices. Casual accounting is a simplified form of bookkeeping that just about anyone can do, while expert-level bookkeeping requires professional knowledge and a deep understanding of financial processes.

It’s like comparing an amateur driver to a professional racecar driver – they’re both driving, yes, but the level of skill and comprehension is vastly different.

Casual Accounting:

As the name suggests, casual accounting doesn’t require extensive training or formal education. Here’s what it involves:

- Recording Simple Transactions: This could be your day-to-day expenses or income from various sources.

- Basic Budgeting: This includes ensuring you stay within budget limits and monitor any extra expenditures.

- Simple Financial Planning: You might plan how much you save each month based on your income.

- Minimal Financial Reporting: This may involve creating basic reports relating to your cash flow.

- DIY (Do-It-Yourself) Tax Prep: Many people with simple financial situations handle their taxes.

This type of bookkeeping serves well those who have uncomplicated transactions or those starting in business. However, as businesses grow or finances become more complex, the shift towards expert-level bookkeeping often becomes necessary.

Expert Level Bookkeeping:

This kind of bookkeeping goes beyond basics and dives deeper into the intricacies that come with handling larger sums of money or running a business:

- Expert Analysis & Forecasting: Professional bookkeepers use past data to give valuable insights about future trends for informed decision-making.

- Detailed Budget Development & Monitoring: An expert adjusts budgets based on close analysis enabling better financial control.

- Comprehensive Financial Reporting: A professional can generate detailed reports that provide crucial information about a business’s economic health.

- Regulatory Compliance: A bookkeeper will ensure that all financial activities of a company are compliant with existing laws and regulations.

- Proficient Tax Preparation: Skilled in tax laws, an expert bookkeeper can maximize deductions and save your business a significant amount of money.

Casual accounting is something you do to keep track of where your money comes and goes. In contrast, expert-level bookkeeping is all about a comprehensive understanding of your finances providing vital information for management decisions and strategic planning. It’s the backbone of the financial health of any serious business.

Also Read: What is Double-Entry Bookkeeping In Accounting?

Different Types of Bookkeeping

Understanding the types of bookkeeping can provide valuable insight into how you can maintain accurate financial records.

Varieties of bookkeeping offer diverse methods that cater to different business needs and sizes. Knowing these different types is a key first step in deciding which process best fits your financial tracking tasks.

The six well-known types of bookkeeping are double-entry bookkeeping, single-entry bookkeeping, tax accounting, auditing, cost accounting, and financial accounting.

All these systems have unique attributes that make them preferable under certain situations. Now let’s dive into each one individually.

Double-Entry Bookkeeping

Double-entry bookkeeping is a comprehensive system used by most businesses today because it offers an efficient way to track where your money comes from and where it goes.

In this method, every transaction impacts two accounts – ensuring precision and parity in record keeping.

For instance, purchasing equipment for cash affects both your equipment account (an increase) and your cash account (a decrease).

It’s like creating a story for each transaction with its characters being debit and credit roles in the financial dramas. As you can imagine; slight goof-ups could create plot holes damaging overall interpretation.

This process helps pinpoint errors or discrepancies quickly since subsequent entries will expose any inaccurate posting instantly by violating the equation: ‘Total debits should always match total credits’.

Despite its complexity compared to other methods discussed later; it’s noted for being meticulous making it popular among medium-to-large organizations that host voluminous transactions daily.

Single-Entry Bookkeeping

Single-entry bookkeeping is much simpler than double-entry as it involves recording only one side of the transaction – either debit or credit action but not both like above.

It’s similar to using a check register where you jot down deposits or payments chronologically without mirroring actions necessarily.

Ideal for small businesses with modest volumes of transactions; this method sees usage primarily due to its simplicity promising less time consumption and expertise needed in maintaining the same.

It doesn’t provide a detailed financial overview due to its lack of depth compared to double-entry bookkeeping. Although not as comprehensive, it can suffice for some small businesses who prefer to track only cash inflows and outflows avoiding complexities.

Tax Accounting

Bookkeeping isn’t always about just recording what’s happening with business finance; sometimes, it’s about forecasting tax implications effectively too.

This is exactly where tax accounting comes into play. It revolves around the concept of preparing and presenting financial information in a way that complies with tax laws.

Tax accounting primarily focuses on income, qualifying expense deductions, or credits to accurately compute tax liability reducing risk associated with non-compliance penalties or missing out on possible deductions improving profitability levels after complying with taxation norms lawfully.

Auditing

While every aforementioned bookkeeping system is crucial for smooth operations; auditing serves as a seal of authenticity gauging the accuracy of underlying records in those systems vouching their credibility for stakeholders involved offering them confidence over your financial stewardship skills within the business operations sphere making audits immeasurably important part validating transparency claims made.

Cost Accounting

Cost accounting is a more internally focused efficiency tool than an external reporting mechanism like others discussed so far. It helps businesses understand the costs associated with each product/service.

They offer to reduce waste and enhance profitability by facilitating strategic business decisions going forward helping startup owners or management bodies control pockets often forgotten.

Otherwise, reminding unique nature of this remarkable type within the bookkeeping spectrum adding toolbox options available to resourceful decision makers act upon backed by insights provided via these reliable cost data led analyses done meticulously.

Financial Accounting

Financial accounting functions primarily as a proactive compliance measure aligning business data format requirements laid down by various regulatory bodies around the world or market functions such as your industry peers stick.

While evaluating performance comparing them yours serving two-pronged purposes satisfying compliance needs and promoting competitive benchmarking tendency among them necessarily market you better light potentially.

If you’ve fared well compared to them during evaluation exercises undertaken at regular intervals showcasing prowess over your financial management duties very smartly via this insight-loaded bookkeeping system for those interested delve deep into understanding you better financially.

This kind of bookkeeping method has served companies greatly in educating stakeholders, enhancing their confidence, and facilitating strategic decisions brilliantly so far.

Also Read: Truck Driver Salary By State: Unveiling The Payday Secrets

How to Maintain Your Books?

In simple terms, maintaining your books means keeping track of your finances accurately. It’s like keeping a diary of what comes in and goes out in your business, helping you stay on top of the financial health of your operations.

But how do you do it efficiently without getting flustered with all the numbers and terminologies? Well, there are two significant points to guide any business owner or entrepreneur looking to master bookkeeping: Categorizing transactions correctly and regular generation of financial statements.

Categorize Transactions Efficiently

Categorizing transactions efficiently is like segregating your income and expenses into different buckets, making it easier for you to comprehend where most costs are incurring or which revenue stream is performing best. Here are a couple of tips that will assist you:

The first step is identifying all the transactions for categorization purposes. These generally include sales, purchases, receipts from customers, or payments made to suppliers.

We must then classify these transactions into various groups based on their characteristics; this could be done using categories like rent/mortgage payments, salaries & wages, advertising costs, etc., depending upon the nature of each transaction.

The key here is consistency – stick to a particular way of categorizing so as not to confuse yourself later down the line when reviewing these data points.

Remember this isn’t just necessary work but strategically vital; successful categorization gives an overview of where money flows within your business which in turn aids the decision-making process massively!

Generate Financial Statements Regularly

Generating financial statements regularly might seem redundant at the start but trust me; this habit can make or break your business’s future!

A routine look at the profit-loss statements (or income statements), balance sheet and cash flow statement can indicate health status indicators timely preventing us from surprises hitting hard.

Imagine having a weekly health checkup! You’d surely catch any irregularities early and take appropriate action similarly in a business context; keeping a check on these figures helps us to understand where we are heading and proactively make changes if needed.

A fundamental tip while drafting these statements is to use the categorized transactions from the previous step, as it further simplifies the process.

What’s more, regularly updating financial statements provides precious information to investors, creditors, and other stakeholders indicating our commitment to transparency and financial discipline.

Finally, I want to emphasize that not every problem or discrepancy caught early will save a business from downfall; however, taking timely precautions boosts our chances of staying afloat during turbulent periods!

Maintaining your books might seem daunting at first but adopting efficient transaction categorization and regular financial statement generation habits can simplify this essential task greatly.

The purpose isn’t just about fulfilling compliance requirements but also making informed choices about your business’s future growth opportunities.

FAQs

What does bookkeeping mean?

Bookkeeping refers to the systematic and consistent process of recording, organizing, storing, and accessing a company’s or individual’s financial transactions. It’s an essential part of accounting that helps track all money-related activities.

What does a bookkeeper do?

A bookkeeper is responsible for recording all daily financial transactions in an organized manner. This includes purchases, sales, receipts, and payments. Their tasks also often involve producing invoices and keeping track of overdue accounts.

What is the basic purpose of bookkeeping?

The primary aim of bookkeeping is to keep a complete and accurate record of all financial entries systematically. This allows individuals or businesses to monitor income and expenditure, ensure legal compliance, provide information to investors or stakeholders, measure profitability over time, and plan for future financial decision-making.

What are the 5 stages of bookkeeping?

The five stages include: documenting financial transactions accurately; posting those transactions into ledgers; balancing ledgers at the end of accounting periods; preparing trial balance accounts by using ledger balances; and finally creating final accounts from trial balance figures which include profit & loss accounts and balance sheets.

Also Read: Pandemic E-commerce Surge Rocketed Truckers Demand!

Conclusion

Managing finances need not be an uphill task. Understanding what bookkeeping and its different types are the initial steps in financial management.

With efficient methods like categorizing transactions and frequent generation of financial statements, one can keep track of their financial health easily.

However, keep in mind that accuracy underpins effective bookkeeping – it helps curtail internal frauds, avoid cash flow issues as well keeping your compliance fears at bay.