Hey there! If you’re on the hunt for a bookkeeping solution that promises to simplify your financial woes, stick around.

This Bench Review is just what you need. Imagine having all your financial records accurate and in one place – that’s exactly what Bench claims to offer. But is it the lifesaver it’s talked up to be? Let’s peel back the layers and dive deep into what makes Bench tick.

Now, are you wondering if Bench is worth your time and cash? In my experience, it sure does a standout job of keeping those pesky numbers in order.

Yes, it comes with some pretty handy features like professional-grade bookkeeping services which save lots of time and money.

And for those looking for peace of mind over their business transactions, accuracy is where Bench shines bright.

What Is Bench?

To put it simply, Bench is an online bookkeeping service designed to simplify business accounting engagingly and effortlessly. It offers financial solutions that go beyond traditional methods, making complicated tracking systems and extensive paper trails a thing of the past.

As a business owner myself, I understand how important efficient bookkeeping can be in successfully running any venture.

Yet many of us struggle with managing our finances due to complex accounting software or lack of time to get on top of our figures.

That’s where Bench comes into play! It provides you with an intuitive interface and professional bookkeepers who handle your books while you focus on growing your business.

How Does Bench Work?

At its core Bench functions as an automated yet personalized bookkeeping tool.

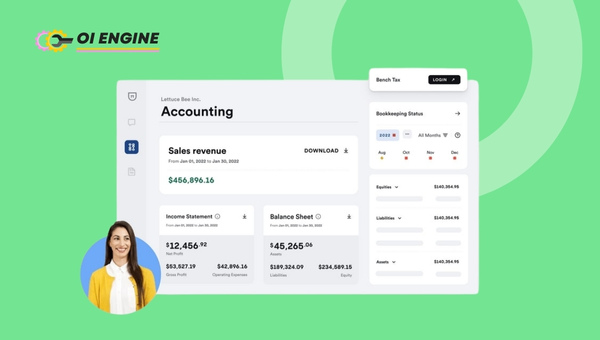

- Intuitive Interface: Firstly, when you sign up for their service, they’ll connect you to their easy-to-use platform where all your financial transactions will be categorized and organized.

- Professional Bookkeepers: Next up is getting paired with a bench team comprising professional bookkeepers who become your go-to resource for any queries.

- Monthly Financial Statement Review: At the end of each month, they prepare income statements and balance sheets which provide detailed insights into your finances.

- Engagement: Communicating with them is just as smooth via phone calls or unlimited messaging through their app.

- Access: Finally what sets them apart at first glance is providing direct access to their experts who guide you through tax season confidently.

This personal touch can make the difference between timely submissions without errors or filing late penalties due to incorrectly filled forms on typical software platforms.

In essence, though Bench may seem just a tool, it is truly more of a service, done for your bookkeeping that allows you to fully utilize its potential without the steep learning curve of conventional accounting software.

Also useful: Your Lawyer Is Dragging His Feet

Assessing the Pros and Cons of Bench

When it comes to bookkeeping and accounting, having a reliable tool in your arsenal is crucial. Bench has positioned itself as an acute solution in this front but like any other utility, it also comes with its pros and cons.

These aspects often play a deciding role when selecting the perfect solution for financial management.

Pros of Using Bench for Accounting

Upon my exploration of Bench, I uncovered several standout advantages that truly set it apart.

- Ease of Use: One of the biggest selling points about using Bench is just how user-friendly it is. The intuitive design makes navigation simple even if you’re not a tech-savvy person.

- Time-Saving: With all its automated features, Bench saves significant time which can be utilized elsewhere constructively.

- Professional Services: When you sign up for their service, you get connected with a professional bookkeeper who handles your accounts efficiently.

- Understandable Reports: Their monthly financial statements are clear and easy to understand which enhances decision making considerably.

- Affordable Plans: Given their high-quality services, their package prices are comparatively reasonable.

While there’s much to appreciate about Bench based on these positive aspects, I found some areas where they might fall short too.

The Downsides of Using Bench

Here are some considerations which may discourage one from using a bench:

- No Payroll or Invoicing Services Offered: Yes! You read it right – presently they do not have any payroll or invoicing functionality within their system.

- Lack of Integration Options: There seems to be relatively fewer integration options available which could be restrictive for businesses requiring these functionalities.

- Yearly-Based Operation: If you’ve kept records on a cash basis throughout the year, then switching over might seem quite tasking because they operate solely on an accrual basis.

- Limited Customization: They currently offer a limited number of customizable reports, which might be restrictive in providing insights tailored to a business’s needs.

- Only USA & Canada Support: It’s crucial to mention that their services are presently only available for businesses based within the USA and Canada.

It becomes quite apparent by weighing the assets against limitations that while Bench brings innovative features and solid value, it may not necessarily be an ideal choice for everyone.

Issues that are Addressed by Using Bench

We often face several challenges while managing our accounts, tracking our transactions, or when preparing financial statements.

Be it small businesses, sole proprietors, or startups, accounting can become a problematic area due to inaccurate records and time-consuming bookkeeping tasks that eat up productive hours.

Not to mention the unnecessary costs we bear for hiring someone to do the job for us! But with Bench, we have found a solution to these issues.

Solving Inaccurate Bookkeeping Issues with Bench

The fear of messing up financial records always looms large in my mind. As most of the business owners would know, one small mistake could lead to a major crisis.

This is where my Bench review started positively since I found Bench exceptionally good in ensuring accuracy in bookkeeping.

The bench has been designed to keep precision at its forefront. The bookkeeper assigned by them works closely with me to ensure all tax write-offs are accounted for and guarantee proper categorization of every single transaction into appropriate expense categories.

What stood out for me is their monthly financial reporting system which offers an injury-free environment for taxes!

They prepare comprehensive income statements and balance sheet reports enabling me to make informed business decisions based on solid data.

Tackling Time-Consuming Bookkeeping Issue

As you dig deeper into my Bench Review, you will find how effectively it addresses one huge pain point for most businesses – time-consuming bookkeeping tasks.

I used to spend countless hours trying to get my head around complex accounting and taxation laws only ending up exasperated at the end.

However, leaving this hefty task on Bench’s capable shoulders has turned out as a big relief! Its user-friendly interface lets me quickly upload all documents related directly or indirectly to financial transactions saving precious time.

Making Bookkeeping Less Expensive

It’s common knowledge that hiring an accountant can be pretty heavy on the pocket, especially for new businesses or solo entrepreneurs.

This is a problem that Bench can very well solve by making professional bookkeeping services more affordable.

The virtual accountants at Bench are equipped to handle all bookkeeping tasks, saving me from additional hiring costs.

Their tiered pricing system accommodates the needs of all businesses big and small – one can pick and choose as per the demands of their enterprise.

More than just a bargain deal, Bench offers the peace of mind that comes from knowing there won’t be any nasty surprise tax bills!

Also Related: Do Mechanics Need CDL? Essential Licensing Guide

Bench review on its Features

One of the reasons why Bench has grown to be a popular choice is due to its comprehensive set of features. The tool offers users just about everything they would need to efficiently handle their bookkeeping needs. Let’s dive into some of these key features.

Cash Basis Accounting

Bench operates on a cash basis accounting system. In the simplest terms, this means that income and expenses are recorded when they are received or paid.

This method is an extremely simple way to track your financial situation, and it’s great for small businesses or individuals who have a straightforward income structure.

Bench’s cash basis system shines when it comes to managing financial records in real time. With this setup, you’re not left guessing about your financial status until the end of the month or the year; instead, your financial picture is always up-to-date because transactions are recorded as soon as they happen.

Cash-based accounting gives you incredible control over your finances. It allows you to see exactly where your money is going, helping you make more informed decisions about spending and saving throughout the year.

Software

The software provided by Bench streamlines every aspect of bookkeeping right at your fingertips – making it manageable even for those with no previous experience in accounting.

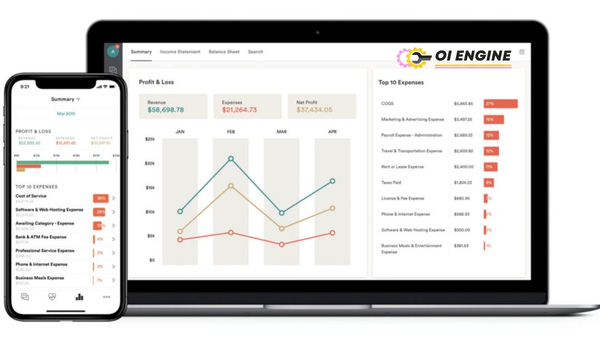

To start with one key function offered -monthly financial reporting- undoubtedly aids long-term planning strategies.

Through generating profit-and-loss statements along with balance sheets every month, stamina for future expansions can certainly be gauged.

Another important aspect I truly appreciate about their software is how easy it makes tax season! No longer does tax filing need to be stressful; with all data meticulously accounted for during the year through utilizing Bench software servicing under ‘Year End Financial Package’, navigating through taxes becomes noticeably easier!

Customer Services

Bench takes pride in providing high-quality customer service – not missing out on any chance to exude their commitment to user satisfaction. Each user is assigned a personal bookkeeping team to aid in assisting you with financial concerns.

From my experience, communication has always been prompt! Mail responses are expected within one business day – teamed with open lines for monthly check-ins to make sure no stone is unturned resulting in effective channeling of their customer communication networks!

Furthermore, being able to speak with knowledgeable personnel rather than automated bots greatly reduces confusion attributing a higher problem-resolution rate making customer support experiences certainly more personalized and hassle-free.

Also Read: Discover Top 19 Paid CDL Training Programs Trucking Offers

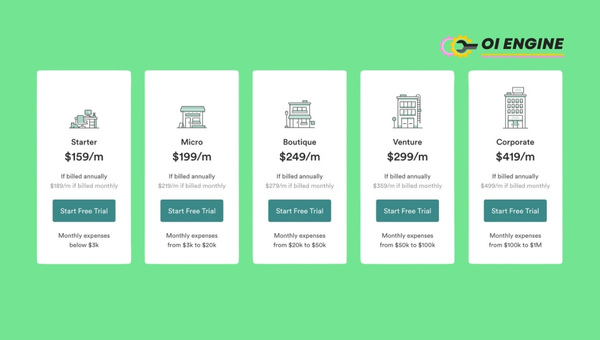

Unveiling Plans and Pricing Provided by Bench

It’s important for myself, and honestly, anyone interested in using a new tool or service, to understand the costs associated with it.

When it comes to Bench, they offer two main plans that nearly any business could fit into. Each of these plans is crafted carefully keeping in mind the specific needs of businesses at different stages.

Essential Plan

The first plan on offer from Bench is the Essential Plan. This one’s priced at $299 per month. You might be thinking this seems a bit steep for bookkeeping services and I would agree with you if it were just any run-of-the-mill service – but it’s not.

You see with this plan, all your monthly bookkeeping tasks are taken care of by Bench’s professional team.

They ensure all financial data is neatly organized and up-to-date each month which takes a huge load off my mind.

At the end of each month, an income statement and balance sheet are prepared without any extra effort from my side!

They have also covered catching up on historical bookkeeping which was quite helpful for me when I had procrastinated on some financial tasks before signing up.

Premium Plan

The second plan is their Premium Plan, offered at $499 per month. This one includes everything in the Essential Plan along with an added valuable feature – taxes! Yes, you read that right!

With this package not only are my monthly bookkeeping duties taken care of but also my tax filings no longer keep me awake at night worrying.

No more sifting through paper piles to find elusive receipts or fretting about potential errors in numbers while filing taxes – I rest easy knowing experts are handling everything professionally and thoroughly due to being backed by their premium support teams who liaise directly with IRS if needed too!

While every business is unique and its needs vary widely, these two plans should cover the bookkeeping needs of most.

Depending on where you are with your business, and what services you require, one of Bench’s plans could fit perfectly with your needs while keeping financial records neat!

Identifying Bench’s Shortfalls

No matter how efficient a product or service might be, there are always areas to work on and Bench is no different. Despite its considerable benefits, this bookkeeping tool has some points where it can’t quite match user expectations. Here are two noticeable areas where Bench falls short.

Lack of Cash Basis Accounting

This means the recording of revenues and expenses only when cash is received or spent. Even though Cash basis accounting is one of the most straightforward methods for documenting transactions, sadly, Bench does not support this method as it majorly operates on accrual accounting.

For small businesses or freelancers who primarily deal with cash transactions, this feature may be essential.

For these individuals, an accounting tool that includes cash-based accounting would be much more helpful because it allows them to record income only when they receive payment – giving them a much more accurate view of their current financial status.

Unfortunately, with Bench, you might lose sight of your immediate financial situation because they’ll however record income even if cash hasn’t been received yet.

This could inadvertently lead to spending money that isn’t really in the bank account yet; thus creating confusion about actual liquidity and potentially leading to unwelcome financial complications.

Customization

Every business owner knows that running a business requires flexibility and customization as all businesses are unique in their ways so why shouldn’t your bookkeeping tool reflect this? Well for Bench, leading towards customization appears like uncharted territory.

Many business owners want the liberty to tailor things according to their specific requirements but unfortunately, one noticeable downside regarding Bench is its limitation when it comes to customization options.

It provides standard categorization choices based on IRS tax categories which may not fit every individual’s criteria perfectly.

Because of this limited option for personalizing records as per our unique needs and preferences often seems like putting round pegs into square holes i.e., aligning our unique business transactions according to standardized categories.

So, despite its many useful features, this lack of customization might disappoint those users who believe in making their bookkeeping procedures truly reflective of their unique businesses.

At the end of the day, this oversight can lead to disorganized records and potential issues during tax time, causing already busy entrepreneurs additional stress and inconvenience.

Also Read: Top 12 Semi-Truck Financing Companies 2024

Alternatives to Consider if Not Bench

In some instances, you might find Bench isn’t quite the right fit for your bookkeeping needs. There could be a variety of reasons for this ranging from specific features you require or a desired cost bracket.

Don’t worry, there are several other bookkeeping software and services available that make for compelling alternatives to Bench.

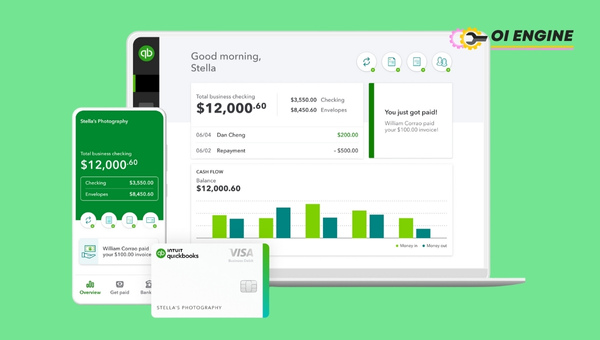

QuickBooks Online

One popular choice is QuickBooks Online. It’s well-regarded in financial circles due to its robust feature set and strong brand reputation.

QuickBooks gives me control over my accounting data with features like income and expense tracking, invoicing, receipt scanning, and automatic bank feeds among others.

You’d also be pleasantly surprised by the comprehensive reports it generates that help me deep dive into my business financials to better understand them.

Another key winning point for this service is its extensive integration with other business applications like PayPal, and Shopify – thereby creating a seamless workflow experience.

The pricing model of QuickBooks varies based on the functionality I need which lets me tailor my costs according to my firm’s requirements – making it an effective solution as an alternative to Bench

Wave Accounting

Another alternative I’d recommend considering is Wave Accounting – especially for small businesses or freelancers who are looking out for cost-effective solutions without compromising on the key features required.

What makes Wave stand apart from many other services is their free access to essential bookkeeping tools such as income and expense tracking or receipt scanning which straightforwardly simplifies day-to-day accounting activities easing the burden significantly.

It should be noted though that while these alternatives offer competent services they do vary fundamentally in operation procedures from Bench but present excellent accounts management potential.

Also check: Discover The Different Types Of Accounting Services

FAQs

Is Bench good for accounting?

Yes, the Bench is an excellent tool for accounting. It offers a unique mix of automated and human-driven solutions that can significantly simplify the bookkeeping process.

How much is Bench per month?

The pricing for Bench starts at $299 per month for their Essential plan which includes monthly bookkeeping services. However, if you also need tax services, their Premium plan costs $499.

How does bench co-work?

Bench operates by integrating online financial sources and automating parts of your bookkeeping to save time and minimize errors. You’ll also have access to a team of bookkeepers who will manage monthly financial routines, prepare tax prep documents, and offer on-demand support.

Does Bench do accrual accounting?

Currently, Bench only supports cash-based accounting, not accrual accounting. This may limit its usefulness for businesses that prefer to account for their transactions when they occur rather than when cash changes hands.

Is Bench worth it?

The value offered by Bench depends on your goals as a business owner. If you’re looking to outsource bookkeeping operations at an affordable rate with easy access to reliable experts, then yes -Bench could very well be worth it.

Also Read: Safeguard With Physical Damage Insurance Coverage

Conclusion

At the end of this Bench review, it is clear to me that Bench provides efficient bookkeeping services. Tailored for small businesses, freelancers, and entrepreneurs, their streamlined accounting solutions are top-notch.

Despite a few cons like their lack of cash-basis accounting or absence of an API, Bench’s strengths significantly outweigh its limitations.

Their sound index of bookkeeping services, along with their exemplary customer service make it worth the investment.

If you decide that Bench is not right for you due to personal preference or other reasons, there are always alternative options available.