When I think about managing money in my business, I know good bookkeeping is key. But figuring out which bookkeeping pricing packages are right for me? That’s a whole other story.

It feels like there are a million options, and each one says it’s the best. Now, if you’re anything like me, you want a package that makes your life easier without breaking the bank. After all, no one likes nasty surprises when it comes to costs.

So what should you expect from bookkeeping pricing packages? Well, let me break it down for you in simple terms.

You want clear prices with no hidden fees – because who has time for that? And the service should match what your business needs; whether you’re just starting or if you’ve been around for a while.

Plus, it’s important that as your business grows, your bookkeeping can keep up without any hassle.

Exploring 19 Popular Bookkeeping Pricing Packages

Understanding the best bookkeeping pricing packages for your business needs can be a daunting task. Fortunately, I’ve done the homework for you.

Let me introduce you to 19 of the most popular bookkeeping pricing packages that cater to various business needs and budgets. In this comprehensive guide, we will delve deep into their features and cost aspects.

1. QuickBooks Live

QuickBooks Live is one of the most renowned bookkeeping services available today providing user-friendly solutions. Here are five noteworthy features:

- Affordable plans: Starting from $200 per month.

- Virtual bookkeeping: Connects you with a dedicated team of U.S-based online bookkeepers.

- Custom setup: Helps in setting up personalized books according to your business requirements.

- Monthly reports: Provide detailed insights every month about your financial functions.

- Support round-the-clock: Offers help whenever you need it with their customer care services.

As far as cost is concerned, their basic plan starts from $200 /month, the Plus Plan at $330/month while Premium comes in at $500/month.

Also Read: Truck Driver Salary By State: Unveiling The Payday Secrets

2. Bench

Bench offers simplified accounting services for small businesses making financial tasks hassle-free. Here’s a brief about what they offer:

- Bookkeeper support: Provides professional support that keeps track of your money in real time.

- Automated financials: Offers automatic import of bank statements and categorization of expenses.

- Tax-ready financial statements: Provides detailed statements useful during tax season.

- Customized reports and advice: Gives custom reports and tips to better manage funds.

- “Catch-up” booking service: If you’re behind on books, Bench can get them up to date.*

Their service costs range between Core at $249.00 per month, Flex at $349.00 per month, and Pro at $479.00 per month.

3. Bookkeeper360

Next comes Bookkeeper360. It’s a medium to large business-oriented service known for its robust features. Here’s what they offer:

- Real-time access to books: Provides 24/7 accessibility to your financial data.

- Dedicated bookkeeper: Offers assistance of a professional bookkeeper.

- HR and payroll support: Helps manage human resources and payroll systems.

- Accurate recordkeeping: Maintains correct records of all financial transactions.

- Month-end review: Ensures no errors in your financial records with meticulous monthly reviews.

Their services pricing begins from $549/month for cash basis accounting and $749 per month for accrual basis accounting, offering full-service virtual accounting solutions.

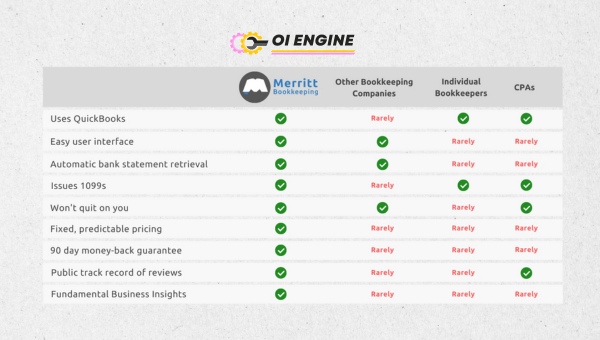

4. Merritt Bookkeeping

Merritt Bookkeeping offers affordable service packages to meet small-scale necessities with five notable features and pricing:

- Affordable Monthly Pricing: Merritt charges roughly $190 per month for their services.

- Secure Client Portal: They provide an efficient client portal that guarantees the safety of confidential data.

- Expert Assistance: The professionals at Merritt are always at hand to offer advice.

- Year-round Reporting: They provide yearly financial summaries to assist with tax returns.

- User-friendly Dashboard: An intuitive dashboard allows you to easily track progress and monitor accounts.

5. Pilot

Pilot is another excellent choice when it comes to bookkeeping pricing packages; they are well-known for their excellent client support team and robust system. Here’s what you get when signing up with Pilot:

- Management Support: You receive assistance from expert accountants who oversee your accounts consistently.

- Detailed Financial Statements: Every month detailed statements are provided accounting for every transaction made during that period ensuring transparency.

- Sync with Business Bank Accounts: Can synchronize well with multiple business bank accounts making it very user-friendly from an integration perspective.

- Personalized Services: They tailor their plans according to what suits your business best

Tax Filing Assistance: They also offer additional help where they preparing accessible records and simplifying the tax filing process

6. 800Accountant

Here’s why many people consider 800Accountant as one of the top choices among other existing bookkeeping pricing packages:

- Convenient Bookkeeping: They streamline services for businesses by handling everything from invoicing to balancing checkbooks.

- Tax Consulting and Planning: 800accountant is not only limited to bookkeeping. It offers comprehensive financial services including tax consulting.

- Certified Staff: The staff at 800accountant are licensed CPAs making them trusted partners for business finances.

- Customizable Plans Like other prominent firms, their plans are also tailored as per your needs with a focus on what best suits the size, nature, and budget of your business.

- Accessible Platform: The online platform provided by 800Accountant is mobile-friendly which makes managing accountant tasks hassle-free even on the go.

7. Bookkeeper

Bookkeeper is another go-to selection when it comes to the arena of bookkeeping pricing packages. With practical application and a wide range of features, it sets a high bar for competitors.

- Cost-Effective Packages: Bookkeeper offers affordable plans with services starting from $125 per month.

- Accurate Record Keeping: I can trust them to keep my records precise, helping me avoid costly mistakes or omissions.

- Secure Data Handling: The platform guarantees secure handling of my data with complex encryption techniques.

- Experienced Professionals: Their team is filled with seasoned professionals who know their work inside out.

- Round-the-Clock Support: Bookkeeper provides 24/7 customer service resolving doubts and queries at any time.

8. inDinero

InDinero is a popular choice due to its comprehensive features designed to cater to both small business owners and larger corporations.

- Detailed Financial Reports: InDinero gives me monthly financial reports that include cash flow, profit and loss, and balance sheets, making it easier for me to grasp where my money goes.

- Unlimited User Access: One distinctive feature they serve is allowing an unlimited number of users access without additional costs.

- Automated Data Entry: They offer automated data entry reducing the risk of errors in recording transactions.

- One-On-One Service: With inDinero, you get personalized one-on-one service from dedicated accountants who understand your business requirements deeply.

- Great Integration Capability: This application seamlessly integrates with other systems like point-of-sale(POS) systems, and payroll processing tools among others.

9. Xendoo

Xendoo is a noteworthy option in this list known for its innovations in the bookkeeping industry including cloud-based services as well as mobile-friendly applications.

- Real-Time Access: Xendoo provides real-time access anytime around the globe which seems to be a boon for international businesses.

- Tax-Savvy Professionals: Their team consists of tax-savvy professionals who help me get the most out of my deductions.

- Compliant Services: Xendoo is conscious of tax compliance and related regulatory requirements – a feature that I find quite favorable!

- Fast Support Response: Their responses are quick ensuring minimal downtime when it comes to solving issues or doubts.

- Integration: Similar to inDinero, Xendoo integrates well with multiple other applications enhancing productivity.

In the end, it’s essential to closely examine the features and costs you’re getting out of these bookkeeping pricing packages that will translate into a significant return on your investment.

10. Acuity

Acuity, a popular choice in bookkeeping pricing packages, offers diverse features and affordable fees tailored to suit your business needs. The features involved in their packages include:

- Full-Service Bookkeeping: They handle all the nitty-gritty details of your company’s finances so you can focus on other important aspects.

- Payroll Processing: This service simplifies payroll management making it easier for businesses to pay employees accurately and on time.

- Tax Preparation and Filing: Acuity helps ensure your tax returns are done accurately to avoid possible penalties from incorrect filings.

- Accounting Software Setup: They assist in setting up various accounting software tools such as Zero or QuickBooks.

- Financial Reporting & Advisory Services: Acuity delivers regular financial reports, and their experienced advisors offer insights on financial planning for the betterment of your business.

While pricing varies according to the individual needs of businesses, their general packages start from $300 per month.

11. Botkeeper

Botkeeper serves as another versatile option in bookkeeping pricing packages unfolding a multitude of benefits among which include:

- Automated Bookkeeping: Leveraging artificial intelligence (AI), Botkeeper automates the most intricate aspects of bookkeeping saving you time and effort.

- Custom Reporting/Dashboards: It provides customized reporting tailored for each type of business which investors can find useful when interpreting data.

- Integration with various applications: It has smooth integration capability with different applications that help facilitate seamless operations.

- 24/7 accounting support: At any point, if you need guidance or have a query, bot keeper’s round-boundaries support service is available to assist you anytime irrespective of day or night

Also Read: Thanksgiving’s Most Dangerous Roads: Tips & Warnings

12. Decimal

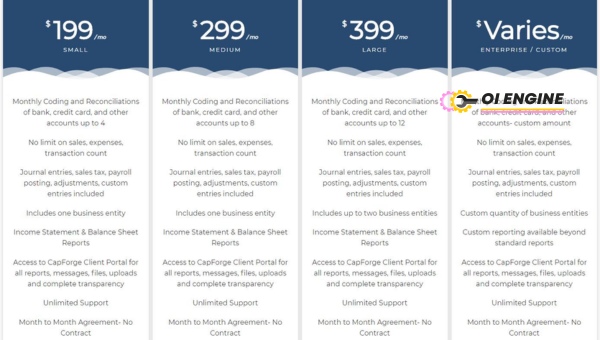

Decimal is another effective solution offering comprehensive bookkeeping services with an array of features including:

- Comprehensive Financial Management: Decimal takes care of everything right from balance sheets to income tax return preparation.

- Fixed pricing structure: Unlike others, Decimal uses a fixed pricing structure which eliminates any surprising costs.

- Digital Receipt Management: This feature keeps track of all digital receipts to help minimize errors and streamline operations.

- Expense tracking: Keeping a tab on your company’s spending becomes easier with Decimal, thus helping you time down unnecessary expenses

- Financial reports delivery: Regular financial reports delivered by Decimal help you stay updated about the overall fiscal health of your firm.

13. Bookkeeping Express

Bookkeeping Express holds a reputable standing in the market due to its core attributes that cater to the needs of diverse businesses. The five main features of its pricing package are:

- Affordable services: It offers quality services at competitive prices, making it a preferred choice for small business owners.

- Customized packages: It enables me to customize the package according to my specific needs and requirements.

- Compliance support: The team at Bookkeeping Express helps with tax compliance, thereby reducing my stress during tax season.

- Online portal access: I have access to an online portal for quick and easy monitoring of my accounts.

- Customer-friendly service: Their customer service is available round-the-clock to address any issues or queries.

The cost of these services varies according to your selected features and customization preferences. However, basic pricing usually starts from $150 per month.

14. Bookkeeping Zoom

Bookkeeping Zoom is another top player in the bookkeeping market that provides exemplary services. Its key features are:

- Smart automation technology: This cuts down on manual tasks by automating data entry tasks.

- Advanced-Data Analysis: It provides advanced financial analysis that can aid in better decision-making for my business

- Real-time monitoring: I can monitor my financials in real time on their digital platform.

- Security assurance: My data is guarded with high-grade encryption methods ensuring maximum security.

- Experienced staff: They have highly skilled professionals who take care of all book-keeping-related responsibilities effectively.

15. Clear Accounting

Clear Accounting offers comprehensive solutions tailored specifically for each business type, which makes it an incredibly versatile choice regardless of your industry or scale. Its notable offerings include:

- Complete Financial Transparency: With Clear Accounting’s software integration, I always have immediate access to a clear picture of your financial standing.

- Budgeting assistance: They provide budgeting help to guide my business in the right financial direction.

- Automatic number crunching: Clear Accounting automatically processes my raw sales data into meaningful insights.

- Reliable tax preparation: This package includes annual tax preparations, making tax season less stressful for me.

- Scalable solutions: Their service is designed to grow with your business, capable of managing increased demand efficiently.

By understanding these different bookkeeping pricing packages, you can make a more informed decision that meets your business’s specific needs and growth plans.

16. FinancePal Business Services LLC

When it comes to comprehensive financial management services, FinancePal Business Services LLC is a worthy contender. Here are some of its key features:

- Global Reach: FinancePal caters to customers across the globe, making it a good fit for multi-national companies.

- Customizable Packages: It offers flexible packages that can be tailored according to business needs and size.

- Monthly Financial Reports: Regular updates on your company’s financial health keep you informed and ready for planning.

- Tax Preparation and Filing Assistance: This feature lessens the burden of tax filing, ensuring accuracy and timeliness.

- Assigned Account Managers: Each client gets a dedicated account manager who handles all finance-related tasks.

This package comes in several pricing options depending on the size and nature of your business. They offer price quotations upon inquiry which allows you to choose what aligns best with your budget.

17. Healy Consultants

Another excellent option is the Healy Consultants bookkeeping service. Here are five distinct features this package offers:

- International Tax Planning Solutions: Their expertise in international tax systems can help streamline operations for businesses operating cross-border.

- Financial Reporting And Analysis: Regular reporting aids in monitoring business performance efficiently.

- Account Reconciliation Services: This helps maintain accurate books by validating company records with bank statements periodically.

- Multi-Currency Accounting: The ability to handle accounts in multiple currencies makes them an excellent fit for global enterprises.

- Budgeting And Forecasting Support: Helps support effective planning, reducing uncertainties about prospects.

While Healy Consultants does not provide specific pricing details up front, they offer customized quotations based on your specific business needs.

18. Ignite Spot Accounting Services

Ignite Spot Accounting Services provides cutting-edge digital bookkeeping solutions suitable for diverse businesses. Its key attributes include:

- Cloud-Based Bookkeeping Systems: A secure, easy-access solution for managing your business finances.

- Dedicated Account Management: Personalized attention from dedicated accountants to manage your account.

- Cash-Flow Improvement Strategies: This service helps to optimize operational efficiency and profitability.

- Financial Reporting And Analysis: Regular reports provide a holistic view of the business’s financial health.

- Payroll Support Services: Automating payroll makes it more efficient and foolproof.

However, the pricing details are not readily available. You need to contact them directly for a custom quote suitable for your needs.

Also Read: Discover The Different Types Of Accounting Services

19. KPMG Spark

KPMG Spark is an online bookkeeping service heralded by the globally recognized audit firm, KPMG. At its core feature set:

- Online Bookkeeping Tools: Real-time insights into business income, expenses, profits, and cash flow on any device through their online bookkeeping tools.

- Tailored Financial Reports: Customizable reports that help focus on metrics that matter most to your business.

- Live Support: Chat with a dedicated bookkeeper whenever you need assistance.

- Automatic Data Importing: Seamless transition of financial data from banks and credit card accounts into the accounting software.

- Tax Preparation Services: Assistance in tax preparation throughout the year without additional charges.

The specific cost of using KPMG Spark’s services is based upon the individual requirements of each client. Hence, customized solutions are recommended which comes after direct consultation with them.

Selecting Appropriate Bookkeeping Pricing Packages

Choosing the right Bookkeeping Pricing Packages for your business can help keep your financial records in order, ensure smooth operations, and plan for future growth.

Making this choice involves carefully considering your business needs and the scalability that these packages offer.

Matching Business Needs

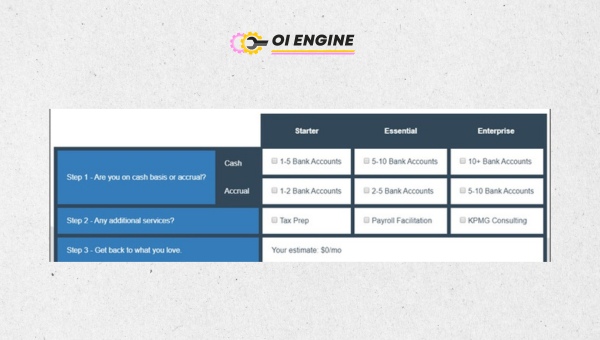

The first step in selecting a good bookkeeping package is to fully understand what my business requires right now.

I sit down and evaluate my current operational state, which includes assessing things like the volume of transactions, employee count, available assets, scale of operations, etc. This helps me identify exactly what I need from a bookkeeping service.

However, acknowledging my present needs isn’t enough. I also need to consider how my business is going to grow and evolve in the future. A trustworthy bookkeeping pricing package should be able to anticipate these changes and have features that accommodate them appropriately.

For example, if I know that over the next year, I’ll be adding more employees or maybe diversifying my products or services – it’s essential then that the package selected can cater to these increases without any extra costs or complications.

Long-Term Scalability

Scalability plays a critical role when choosing any service for my business – particularly those associated with finance like bookkeeping packages.

By long-term scalability here, it refers not only simply to growing with time but rather to growing smartly balancing price and quality – value for money.

A package might seem cheap now but as my company grows bigger with increased financial transactions; additional features may become necessary leading eventually to higher costs.

This sudden cost surge can hit hard on tight budgets therefore; consideration must be given at the very start (at the selection stage) towards foreseeing how adaptable it can be during peaks of growth while maintaining manageable costs simultaneously.

FAQs

How do you set pricing for bookkeeping services?

Setting the price for bookkeeping services usually involves assessing the complexity of the client’s financial activities, the amount of transactions, and any additional services required. Market rates and expertise levels also play crucial roles.

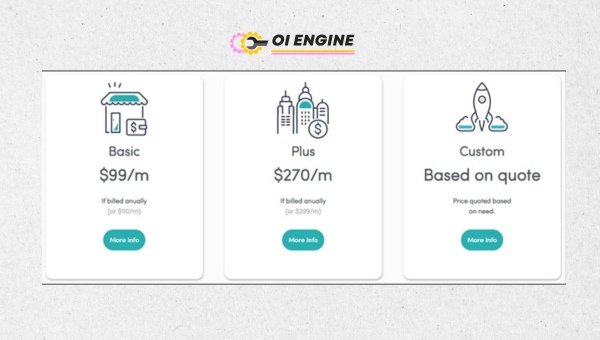

How do you package bookkeeping services?

Packaging bookkeeping services often include offering different levels of service, such as basic, standard, and premium. Each package can cater to different sizes of businesses or complexities of bookkeeping needs, including monthly reconciliations, financial reports, and payroll management.

What is full-charge bookkeeping?

Full charge bookkeeping refers to managing all aspects of a company’s accounting needs. This includes handling all entries in the ledgers, preparing financial statements, managing accounts payable and receivable, payroll processing, and tax preparation.

Is bookkeeping service profitable?

Yes, offering bookkeeping services can be highly profitable when managed efficiently. Leveraging technology to streamline processes allows for serving more clients without sacrificing quality or accuracy.

How do you set price from cost?

Setting a price from cost involves calculating how much it costs to provide your service and then adding a markup to ensure profitability. The markup should cover overheads like office expenses and salaries while allowing a reasonable profit margin.

Also Read: Reefer Breakdown Coverage: Secure Your Cold Transport

Conclusion

In exploring bookkeeping pricing packages, the choices can seem overwhelming. From QuickBooks Live to Merritt Bookkeeping, each package offers its unique benefits and challenges.

When searching for the right option, assessing value for money is crucial. It’s not just about the cheapest option but finding a package that meets your business’s specific needs without hidden costs.

Remember, transparency and matching services to your requirements are key in choosing a bookkeeping pricing package. This step is about investing in your business’s financial health, so take your time to review and decide wisely.