As we tread further into the digital era, the increasing need for robust and trustworthy virtual bookkeeping services becomes necessary.

If you’re on a quest to explore the cutting-edge realm of online accounting, prepare to find your perfect match from this list of top navigators.

Whether you’re after cost-effective solutions or premium features, I’ve got something for everyone here.

In today’s rapidly evolving digital landscape, one cannot simply overlook the immense benefits brought by virtual bookkeeping services.

Getting ahead with your finances and business transactions has never been so easy. With our handpicked selection for the year 2025 including options like AccountEdge Pro, KashFlow, and Deskera Books amongst others; financial management is about to become more effortless than ever before.

20 Best Virtual Bookkeeping Services for 2025

The world of business is continuously changing, and it’s no secret that managing financial numbers can be a daunting task.

But with the rise of technology comes a simplified solution to this problem: Virtual Bookkeeping Services. These companies provide online accounting assistance that’s both efficient and reliable.

Today, I’m going to share with you the 20 best Virtual Bookkeeping Services for 2025.

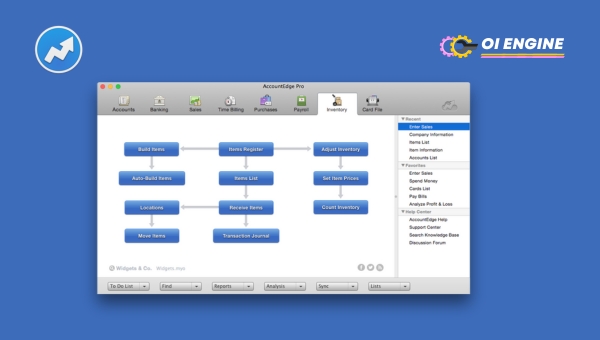

1. AccountEdge Pro

AccountEdge Pro is known industry-wide as an all-rounder when it comes to virtual bookkeeping services. This platform offers comprehensive features designed to streamline your business financials.

Features:

- Comprehensive payroll processing.

- Inventory management capabilities.

- Detailed customer info management.

- Multicurrency support for global businesses.

- Project budgeting and cost tracking.

Pros:

- User-friendly interface makes it easy to navigate.

- Impressive inventory management system.

- In-depth reports providing clear insights into your financial status.

Cons:

- The desktop version may be complicated for novices in bookkeeping software use.

- No integrated direct deposit feature is available in the payroll function right now (as of 2023).

- The absence of a dedicated mobile application which some users might find inconvenient.

2. KashFlow

Ideal for small businesses, freelancers, and start-ups, KashFlow offers simple but robust virtual bookkeeping tools catering primarily to the UK market.

Features:

- The ability to automate recurring purchases/invoices.

- Mobile app availability for iOS and Android devices gives you access anytime anywhere.

- Multi-currency support is suitable for businesses dealing internationally

- The credit-control feature allows tracking overdue invoices easily

- VAT Return generation simplifies tax reporting needs

Pros:

- Simple enough even for those without much accounting background

- The responsive customer service team provides excellent help when needed

- Pricing plans are budget-friendly and hence ideal for small businesses

Cons:

- Payroll service requires additional payment, not included in the standard package

- No integrated inventory management

- Somewhat narrowed views as it’s primarily for the UK market, though they do provide adaptable business taxation for global trading.

3. BookKeeper

BookKeeper is a budget-friendly yet effective solution for small to medium-sized businesses providing a wide array of bookkeeping features.

Features:

- Inclusive banking integration allows automatic transactions.

- Mobile app availability on both iOS and Android platforms.

- Accounts Receivable & Payable tracking system.

- Customizable invoices and estimates.

- Budgeting and forecasting tools available to plan future expenses

Pros:

- Intuitive user interface promoting easy usage

- Affordability paired with useful features makes this an excellent choice for SMEs

- Stable performance with minimal software issues according to user feedback

Cons:

- Might lack advanced features required by large businesses or certain specialized industries.

- Customer service response can take some time, based on user feedback.

- The payroll function is basic, not accommodating complex employee compensation scenarios.

Also Read: What is Double-Entry Bookkeeping In Accounting?

4. Deskera Books

Deskera Books is one feature-rich software that many businesses vouch for. Among its standout features are:

- Comprehensive accounting suite

- Automated invoicing

- Multicurrency support

- Detailed financial reports

- Multi-user access

Deskera books may earn brownie points with its user-friendly interface and easy integration with other platforms. It also shines bright in providing real-time insights into your business finances.

On the flip side, it may throw up challenges like limited customization options and occasional lags in performance during peak hours. The customer service too could do with some improvement.

Pros:

- User-friendly software.

- Fast & easy integration.

- Provides real-time financial insights.

Cons:

- Limited customization options.

- Can be slow during peak usage times.

- Customer service could use improvements.

5. BUSY Accounting Software

BUSY accounting software is yet another high-performing candidate on my list that covers all bases when it comes to managing your company’s accounts.

This powerhouse packs in features like:

- Inventory management

- GST invoicing & returns filing

- Financial Accounting

- Multi-currency management

- Payroll management

As an entrepreneur or business owner, you would appreciate its comprehensive functionalities addressing all your inventory and accounting needs seamlessly integrated into one software package which is amazingly user-friendly at its core.

However, every silver lining has a cloud. BUSY software might disappoint you a bit with its slightly outdated interface and steeper learning curve for beginners. And yes, its higher pricing bracket could also pinch some.

Pros:

- Comprehensive functionalities

- Seamless integration of all features.

- Very user-friendly

Cons:

- The interface is a bit outdated.

- Slightly challenging for beginners.

- A bit on the pricey side.

6. Botkeeper

Botkeeper, the AI-driven virtual accountant, has ignited quite an interest amongst my circle of entrepreneurs with its futuristic approach to bookkeeping.

Its impressive feature set includes:

- Automated bookkeeping entries

- Financial dashboard

- Machine learning-based categorization

- 24/7 support through bot chat

- Comprehensive financial reporting

With Botkeeper, you can streamline your accounting process by efficiently automating routine tasks while gaining access to real-time insights anytime, anywhere.

While it certainly ups your tech-savvy game in business circles, this software may prove to be slightly overwhelming for those not very comfortable with advanced tech terms and concepts.

Besides that, there could be occasional glitches in synchronization and limited customization capabilities too which may sometimes act as setbacks.

Pros:

- Efficient automation of routine tasks.

- Real-time access anywhere.

- Financial insights at your fingertips.

Cons:

- Can be complex for non-tech folks.

- Occasional synchronization issues.

- Limited customization options.

7. ClearBooks

ClearBooks is an online bookkeeping software that offers a straightforward and accessible approach to managing your finances.

Key Features of ClearBooks:

- Streamline the way you manage sales, purchases, and contacts.

- Find peace of mind with automated invoicing and reminders.

- Enjoy customizable special reports tailored to your business needs.

- Benefit from secure cloud storage for all your financial data.

- Take advantage of full compliance with accounting regulations.

Pros of Using ClearBooks:

- Convenient online access means you can manage your books anytime, anywhere.

- Its user-friendly interface makes it easy even for non-accountants to use.

- Excellent customer support ensures your queries get resolved quickly.

Cons of Using ClearBooks:

- Importing data from other software can seem a bit complicated at first.

- Some users might find the pricing structure somewhat high compared to other providers.

- They do not offer phone support which can be frustrating in case of complex issues.

8. ZarMoney

ZarMoney is an enterprise-level accounting solution that scales with your business, designed to simplify the process no matter how complex it gets.

Key Features of ZarMoney:

- Improve productivity with automated tools such as default customer settings and rapid item input.

- Manage inventory effortlessly through functions like tracking by location or section.

- Accurate profit insights due to cost-of-goods-sold tracking on hand-to-hand transactions.

- A comprehensive transaction history gives you an in-depth understanding of where money goes.

- Integration possibilities with numerous external platforms such as payroll software, POS systems, etc.

Pros Of Using ZarMoney:

- Its versatility makes it suitable for all kinds and sizes of businesses

- The design is intuitive resulting in a shorter learning curve

- Real-time data updates increase accuracy tremendously Cons Of Using ZarMoney:

- Limited customization options restrict an individualistic approach to accounting

- They might occasionally have slower loading times that can delay tasks

- It’s a bit more expensive as compared to other providers in the market.

9. Wave

Wave is known for providing free and user-friendly accounting modules, perfect for freelancers, start-ups, and small businesses.

Features Of Wave:

- Easy-to-use invoicing with automatic reminders, ensuring you get paid on time.

- Expense tracking that categorizes your expenses, relieving you from paper receipts.

- Seamless integration with your bank allows transactions from bank and credit cards to flow into Wave automatically.

- Full suite payroll service including benefits management in select locations.

- Safe cloud storage keeps all your financial information secure.

Pros Of Using Wave:

- The core features are free of charge, making it an economical choice.

- A simple interface means even beginners can manage their bookkeeping effortlessly.

- Multiple customization options enable users to tailor invoice designs according to their brand’s theme.

Cons Of Using Wave:

- Some standard features come with additional costs which could add up over time.

- Despite offering a wide range of features they lack project tracking ability.

- Restricted access outside Canada and the USA may limit its use for global businesses.

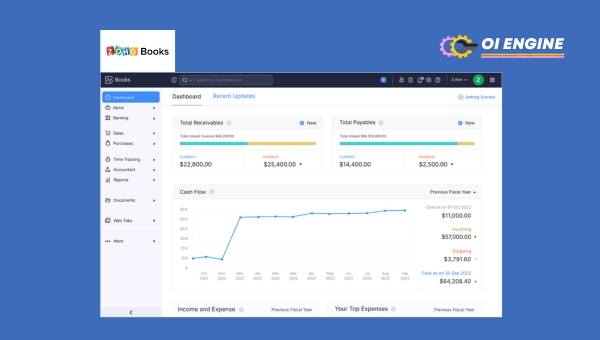

10. Zoho Books

Zoho Books is a cloud-based accounting application designed for small businesses. It’s reliable, user-friendly, and packed with key features that make it a strong contender in the virtual accounting arena.

Features:

- Comprehensive robust dashboard

- Invoices and estimates

- Expense tracking

- Bank reconciliation

- Multi-currency support

Pros:

- Easy-to-navigate interface

- Seamless integration with other Zoho applications

- Excellent customer support

Cons:

- Limited third-party app integration

- Lack of advanced inventory management

- Could be price-prohibitive for some businesses

Zoho Books simplifies financial tasks by automating them, leaving entrepreneurs more time to focus on growing their businesses.

However, its limitations when it comes to integrating other third-party apps might be something businesses would need to consider.

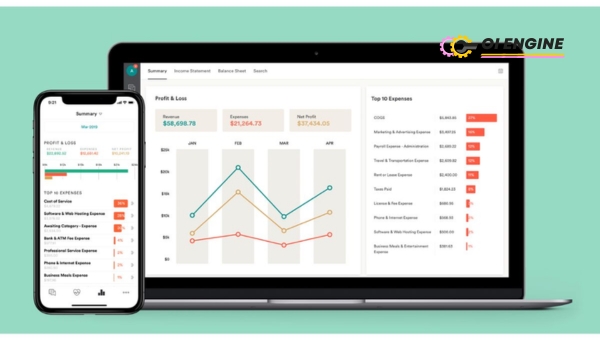

11. FreshBooks

FreshBooks is another top-rated virtual bookkeeping service, famous for its robust features and user-friendly interface. It’s an excellent fit for freelancers and small businesses.

Features:

- Customizable invoices

- Time tracking

- Expense tracking

- Online payments

- Project management

Pros:

- Intuitive design and easy to use

- Excellent customer support

- Great mobile app

Cons:

- Expensive for multiple users

- Limited features on lower-tier plans

- No inventory management

While FreshBooks shines in terms of usability and customer support, the cost might be a limiting factor for some businesses.

Also, it does not include inventory management, which could be a setback if you’re dealing with physical products.

12. Bookkeeper360

Bookkeeper360 is a virtual bookkeeping service famed for providing extensive financial solutions. It primarily concentrates on industries like e-commerce, real estate, non-profit organizations, and more.

Features:

- Real-time financial insights

- Payroll services

- Cash flow management

- Business tax planning & preparation

- Advisory services

Pros:

- Direct consultation with Certified Public Accountants (CPAs)

- Comprehensive dashboard with valuable insights

- An all-in-one platform for accounting needs

Cons:

- Slightly expensive compared to competitors

- Doesn’t integrate with all e-commerce platforms

- Some interface elements might seem complex to new users

Despite being slightly pricier than rivals, Bookkeeper360 makes up for it with its comprehensive features and direct access to CPAs.

However limited integration capabilities and some interface complexities are worth considering before you decide to go all-in with this platform.

Also Read: Bookkeeping Tips: 19 Surefire Strategies for Financial Order

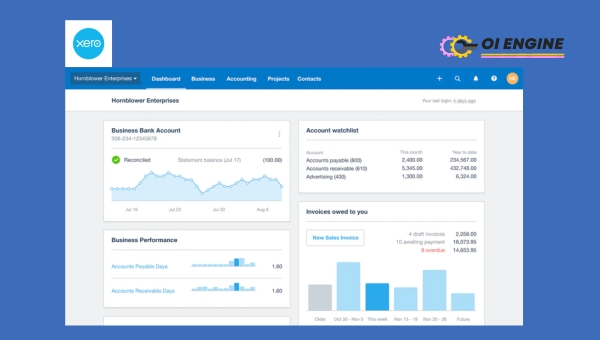

13. Xero

In the world of virtual bookkeeping services, Xero stands out as a powerful tool that transforms complex accounting tasks into manageable actions.

Features:

- Easy invoicing

- Inventory management

- Payroll assistance

- Over 700 app integrations

- Detailed financial reporting

Pros:

- User-friendly interface

- Strong security measures

- Excellent mobile apps

Cons:

- Limited functionality on the starter plan

- Additional cost for premium features

- Some features may have a steep learning curve

Every business owner who uses Xero can attest to its ease of use and strong security measures. Though it comes with excellent mobile apps, there might be some extra costs if further premium features are required.

14. Sage Intacct

Sage Intacct might be the perfect pick for businesses aiming to streamline their financial management processes.

Features:

- A multi-dimensional general ledger that allows more detailed data analysis.

- Real-time financial visibility and analytics are available round the clock.

- Bill management and cash flow control were made simpler.

- Robust security with strict protocols in place to protect data.

- Scalability, allows businesses to grow without constraints.

Pros:

- Powerful customization options make it adaptable to business needs.

- Excellent integration with other systems such as CRM, payroll, etc.

- Incredible customer support service is available whenever you need help.

Cons:

- It can be a little more expensive than other similar services in the market.

- Getting used to the interface may take some time initially due to its detailed features.

- Some users have reported occasional software bugs disrupting workflow.

15. QuickBooks Online

QuickBooks Online is a power-packed accounting solution developed by Intuit, which has already earned a lot of trust from its users.

Features:

- The mileage tracking feature is available for those who are constantly on the move for their business chores.

- Efficiently categorizes expenses so that tax-saving becomes easier at year-end

- User-friendly interface ensuring easy navigation.

- Data syncs across devices enabling remote access whenever needed

- Automatically calculates sales tax based on location, thus eliminating manual calculations.

Pros:

- With cloud-based access, your accounts can be managed anytime and anywhere.

- A large variety of integrations; connect it with your favorite apps seamlessly

- Offers a flexible range of plans suitable for different business sizes and requirements

Cons:

- Customer service wait times may sometimes be longer than expected

- For some industry-specific features, you may need to add on apps or extensions at extra cost

- Transitioning from the Desktop version to the Online version can be a bit tricky

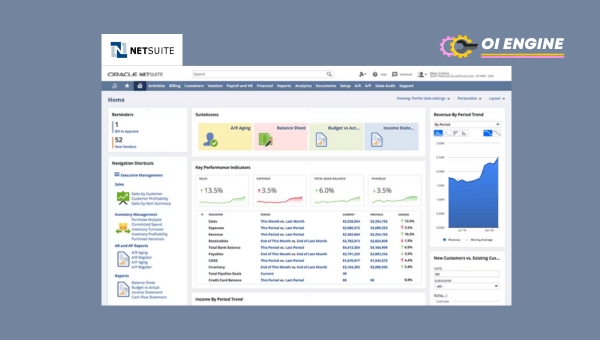

16. Netsuite

NetSuite, developed by Oracle, is a comprehensive accounting solution suitable for businesses of all sizes.

Features:

- A customizable dashboard that presents key performance indicators for easy analysis

- Built-in eCommerce platform helps manage your online business in one place

- Automated fixed asset tracking from procurement until disposal

- Advanced inventory management capabilities with detailed visibility into stock

- Multi-language and multi-currency support for global businesses

Pros:

- Scalable enough to grow with your business without causing disruptions

- Real-time data updates across all operating locations

- Versatile reporting features, allow you to keep track of every aspect of the business

Cons:

- It may take some time to learn all its advanced features

- The implementation process can be lengthy and sometimes complex

- The custom functionalities could potentially increase costs.

17. Maxim Liberty

The first virtual bookkeeping service that I recommend checking out is Maxim Liberty. This service stands out with its impressive features that make financial management a breeze. These include:

- Automated transaction recording

- Monthly financial statement generation

- General ledger maintenance

- Payroll processing

- Tax filing support

Since no service is perfect, let’s also review some of the pros and cons of using Maxim Liberty.

Pros:

- User-friendly interface – even if you’re not tech-savvy, you’ll have no issues navigating around.

- Excellent customer support – their team is always eager to help deliver the best possible experience.

- High accuracy in data handling – makes your financial dealings error-free.

Cons:

- Does not come with a mobile app – this can be inconvenient if you usually manage your finances on the go.

- Relatively expensive than other available services – might not be suitable for startups on tight budgets.

- Limited customization options – some users might find it lacking flexibility.

18. Xendoo

Xendoo follows closely on my list because it offers an amazing set of features for a smooth bookkeeping journey:

- Weekly business reports

- Monthly profit and loss statements

- Accurate balance sheet preparation

- Customized tax calendar

- Access to a dedicated CPA

But just like any other product or service, Xendoo has its strengths and weaknesses worth considering.

Pros:

- Provides real-time access to your books via their cloud-based platform – this feature goes a long way to ensure maximum accuracy.

- Its pricing model is easy-to-understand and transparent meaning there won’t be nasty surprises along the way.

- Includes handy tax consulting services which could save both time and money when navigating tax season.

Cons:

- An initial setup fee is required which can add considerably to the overall cost of the service.

- No free trial period is offered – you only get to learn about how your bookkeeping system works until you have paid for a contract.

- If you need extensive financial advice, this might not be the best place as their focus is more on bookkeeping and tax services.

Also Read: California Leads In EV Chargers, Struggles With Green Power

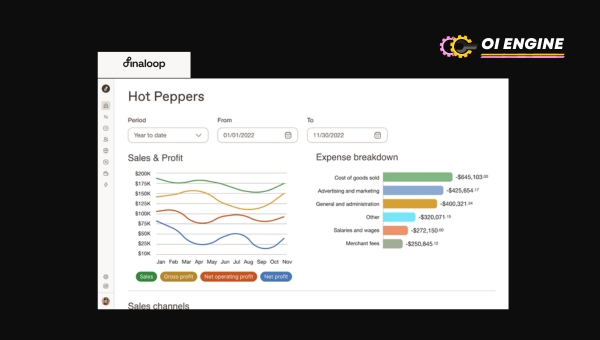

19. Finaloop

Coming up next is Finaloop, an innovative virtual bookkeeping service that combines technology with human expertise to deliver top-notch financial management:

- Advanced accounting dashboard

- Profit monitoring

- Cash flow analysis

- Financial forecasting

- Outsourced CFO services

As always, let me quickly share some pros and cons of using Finaloop.

Pros:

- Its platform is robust yet easy to use making finance management less challenging.

- Excellent email support in case of any issues or inquiries.

- Offers a free trial – a great way to test out their features before making a financial commitment.

Cons:

- Long-term contracts are mandatory which might not be ideal for businesses looking for short-term options.

- Setup could be quite complicated – someone without basic accounting knowledge may struggle initially

- While it offers discounted pricing for multiple businesses, these deals don’t extend to single-business users

20. Reconciled

Finally, this list couldn’t end without mentioning Reconciled – an award-winning virtual bookkeeping service recognized by Intuit QuickBooks:

- Customized bookkeeping sessions

- Receivables and payables tracking

- Account reconciliation

- Payroll assistance

- Management reporting

Here are my thoughts on its pros and cons:

- Pros:

- Provides access to certified bookkeepers which can make your financial data highly reliable.

- No hidden fees or charges guaranteeing full transparency in pricing.

- Personalized approach – they tailor their services according to your specific business needs.

- Cons:

- Lacks a mobile app platform which will not serve mobile-dependent users well.

- Service may get slowed down during peak times or high-demand periods.

- The hourly pricing model can accumulate to cost much more than anticipated.

FAQs

What does a virtual bookkeeper do?

A virtual bookkeeper handles your financial records over the web. They track your transactions, manage bank feeds, reconcile accounts, and prepare financial statements.

How much can you make as a virtual bookkeeper?

Earnings vary widely. Some virtual bookkeepers make between $35 to $60 per hour depending on expertise, services offered, and client demand.

How do I start a virtual bookkeeping business?

You’ll need a good grasp of accounting principles and software. Set up a home office, decide on services to offer, set your rates, and begin marketing yourself online or through local networks.

Are virtual bookkeepers in demand?

Yes! With more businesses operating online, there’s a growing need for remote financial management.

Why hire a virtual bookkeeper?

Hiring one helps save time on finance-related tasks. You can focus more on running your business while they take care of the books.

Also Read: 15 Best-Paying Industries for Truckers to Consider

Conclusion

Navigating the financial world can be overwhelming. As a business owner, numerous tasks demand your attention.

And that’s where virtual bookkeeping services come into play. Based on my research for 2025, I believe the 20 presented in this article are the top ones offering excellent service, flexibility, and value for money.

They simplify operations by taking care of your financial records so you can focus on growing your business. From AccountEdge Pro to Reconciled, these bookkeeping services provide peace of mind by managing finances with precision and professionalism.